Market Growth Projections

The Global Vehicle Pillar Market Industry is poised for substantial growth, with projections indicating a market value of 8.89 USD Billion in 2024 and an anticipated increase to 16.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.47% from 2025 to 2035. Such figures reflect the industry's resilience and adaptability in the face of evolving consumer preferences and technological advancements. The market's expansion is likely to be driven by factors such as increased vehicle electrification, enhanced safety features, and the integration of smart technologies, all of which are shaping the future of the automotive landscape.

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles is a pivotal driver in the Global Vehicle Pillar Market Industry. As environmental concerns gain traction, more consumers opt for electric vehicles, which are perceived as more sustainable alternatives to traditional combustion engines. This shift is reflected in the projected market growth, with the Global Vehicle Pillar Market expected to reach 8.89 USD Billion in 2024. Governments worldwide are also incentivizing electric vehicle adoption through subsidies and tax breaks, further propelling this trend. The transition to electric vehicles not only reduces carbon emissions but also aligns with global sustainability goals, indicating a robust future for the industry.

Growth of Ride-Sharing and Mobility Services

The rise of ride-sharing and mobility services is reshaping the Global Vehicle Pillar Market Industry. As urbanization accelerates, consumers are increasingly favoring shared mobility solutions over traditional vehicle ownership. This shift is driven by convenience, cost-effectiveness, and the desire for sustainable transportation options. Companies like Uber and Lyft are expanding their services, which in turn influences vehicle design and production strategies. The market's growth trajectory, with an expected value of 8.89 USD Billion in 2024, suggests that manufacturers will need to adapt their offerings to meet the demands of this evolving consumer behavior, potentially leading to innovative vehicle designs tailored for shared use.

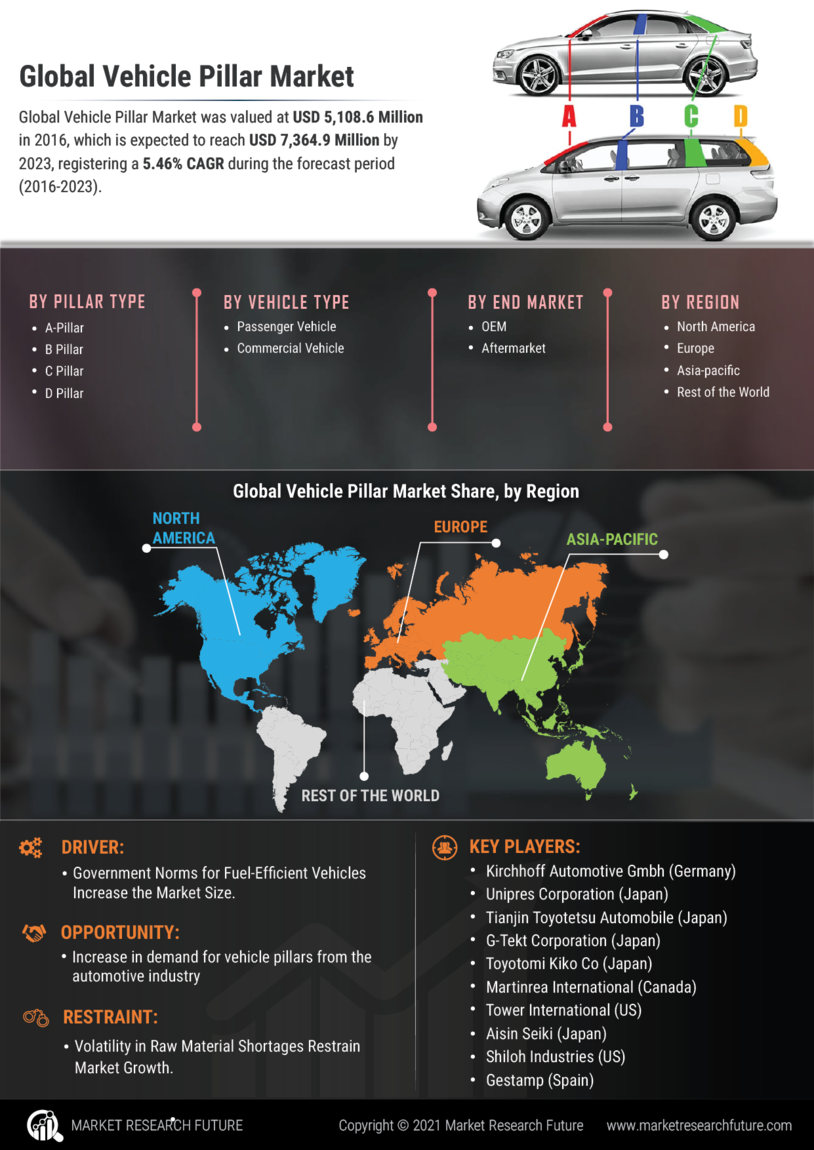

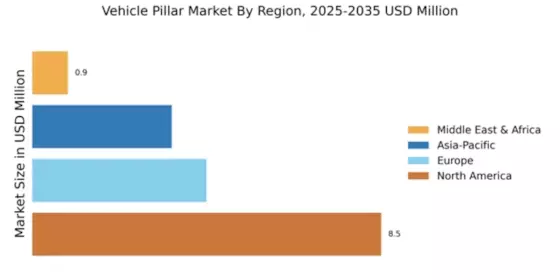

Government Regulations and Emission Standards

Stringent government regulations and emission standards are driving changes in the Global Vehicle Pillar Market Industry. As nations implement stricter environmental policies, automotive manufacturers are compelled to innovate and produce vehicles that comply with these regulations. This trend is particularly evident in regions such as Europe and North America, where emissions targets are becoming increasingly ambitious. Compliance not only enhances brand reputation but also opens up new market opportunities. The expected compound annual growth rate of 5.47% from 2025 to 2035 indicates that manufacturers who adapt to these regulations will likely thrive in the evolving market landscape.

Consumer Preferences for Advanced Safety Features

The growing consumer demand for advanced safety features is a crucial driver in the Global Vehicle Pillar Market Industry. As safety becomes a paramount concern for buyers, manufacturers are increasingly incorporating technologies such as automatic braking, lane-keeping assistance, and adaptive cruise control into their vehicles. This trend is not only enhancing consumer confidence but also influencing purchasing decisions. The anticipated market growth, projected to reach 16.0 USD Billion by 2035, indicates that manufacturers who prioritize safety innovations are likely to capture a larger share of the market. This focus on safety aligns with broader societal trends towards improving road safety and reducing accident rates.

Technological Advancements in Automotive Manufacturing

Technological innovations in automotive manufacturing are significantly influencing the Global Vehicle Pillar Market Industry. Advanced manufacturing techniques, such as automation and robotics, enhance production efficiency and reduce costs. Moreover, the integration of smart technologies, including AI and IoT, facilitates the development of connected vehicles, which offer enhanced safety and user experience. These advancements are likely to attract investments, as manufacturers seek to modernize their production lines. The anticipated growth of the market, projected to reach 16.0 USD Billion by 2035, underscores the importance of these technological developments in shaping the future landscape of the vehicle industry.