Aging Infrastructure

The deterioration of aging water infrastructure is a significant driver for the Valves in Water and Wastewater Market. Many regions are grappling with outdated piping systems that require urgent upgrades to prevent leaks and inefficiencies. According to estimates, approximately 30% of treated water is lost due to leaks in aging systems. This alarming statistic underscores the necessity for modern valve solutions that can enhance system integrity and reduce water loss. As municipalities prioritize infrastructure renewal projects, the demand for high-quality valves is expected to surge. The Valves in Water and Wastewater Market stands to benefit from this trend, as investments in infrastructure modernization are likely to create new opportunities for valve manufacturers and suppliers.

Increasing Water Scarcity

The escalating issue of water scarcity is a critical driver for the Valves in Water and Wastewater Market. As populations grow and climate change exacerbates drought conditions, the demand for efficient water management solutions intensifies. Valves play a pivotal role in controlling water flow and ensuring optimal distribution. According to recent data, nearly 2 billion people currently live in water-stressed areas, highlighting the urgent need for effective water infrastructure. This situation compels municipalities and industries to invest in advanced valve technologies that enhance water conservation and reduce wastage. Consequently, the Valves in Water and Wastewater Market is likely to experience substantial growth as stakeholders seek to implement innovative solutions to address these pressing challenges.

Technological Innovations

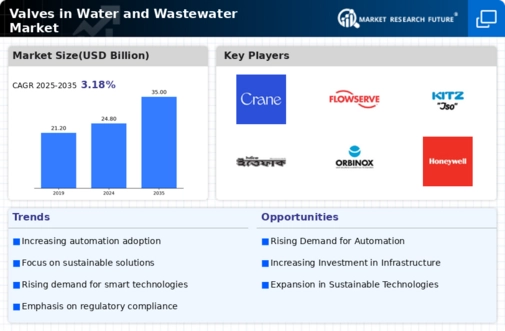

Technological advancements are reshaping the Valves in Water and Wastewater Market, driving the adoption of smart and automated valve systems. Innovations such as IoT-enabled valves allow for real-time monitoring and control, enhancing operational efficiency and reducing maintenance costs. The integration of smart technologies is particularly relevant in urban areas where water management is becoming increasingly complex. Data indicates that the smart water management market is projected to grow significantly, with a substantial portion attributed to advanced valve technologies. As utilities seek to optimize their operations and improve service delivery, the demand for innovative valve solutions is likely to rise, positioning the Valves in Water and Wastewater Market for robust growth in the coming years.

Rising Environmental Concerns

Growing environmental awareness is a driving force behind the Valves in Water and Wastewater Market. Stakeholders are increasingly recognizing the importance of sustainable practices in water management. This shift in mindset is prompting investments in eco-friendly valve technologies that minimize environmental impact. For instance, valves that reduce energy consumption during operation are gaining traction among industries aiming to lower their carbon footprint. Furthermore, the emphasis on reducing wastewater discharge into natural water bodies is leading to the development of advanced valve systems that ensure compliance with environmental standards. As the focus on sustainability intensifies, the Valves in Water and Wastewater Market is likely to evolve, with manufacturers innovating to meet the demands of environmentally conscious consumers.

Regulatory Compliance and Standards

Stringent regulations regarding water quality and wastewater management are driving the Valves in Water and Wastewater Market. Governments and regulatory bodies worldwide are enforcing laws that mandate the treatment and safe disposal of wastewater. This regulatory landscape compels industries to adopt advanced valve systems that meet compliance standards. For instance, the implementation of the Clean Water Act in various regions necessitates the use of reliable valves to ensure proper wastewater treatment. As a result, the market for valves is expected to expand as companies invest in technologies that not only comply with regulations but also enhance operational efficiency. The ongoing evolution of these standards suggests that the Valves in Water and Wastewater Market will continue to adapt and innovate in response to regulatory pressures.