Rising Prevalence of Neurological Disorders

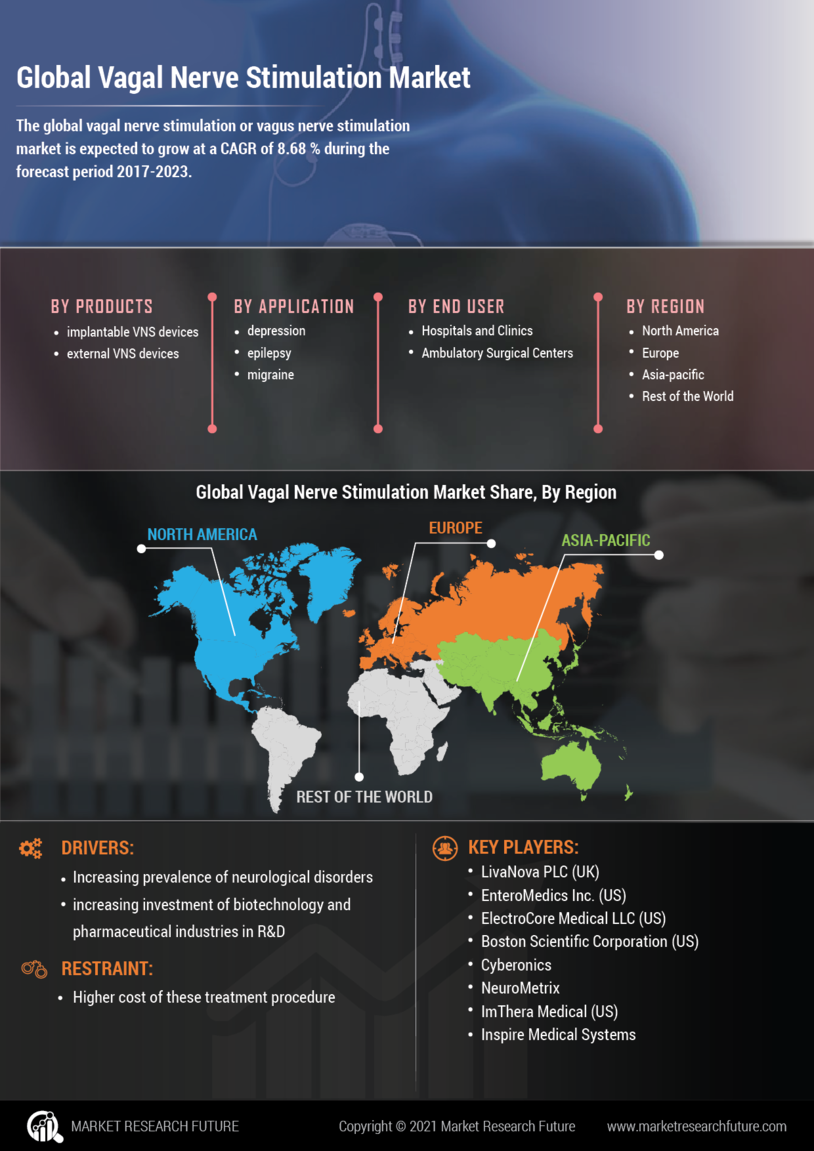

The increasing incidence of neurological disorders, such as epilepsy and depression, is a primary driver for the Vagal Nerve Stimulation Market. As per recent estimates, approximately 50 million individuals are affected by epilepsy worldwide, leading to a heightened demand for effective treatment options. Vagal nerve stimulation has emerged as a viable alternative for patients who do not respond to conventional therapies. This growing patient population necessitates innovative solutions, thereby propelling the market forward. Furthermore, the rising awareness of treatment options among healthcare providers and patients contributes to the market's expansion. The Vagal Nerve Stimulation Market is likely to witness sustained growth as more individuals seek advanced therapeutic interventions.

Increasing Investment in Neuromodulation Research

The surge in investment directed towards neuromodulation research is a crucial factor propelling the Vagal Nerve Stimulation Market. Governments and private entities are allocating substantial funds to explore the therapeutic potential of neuromodulation techniques, including vagal nerve stimulation. This financial support fosters innovation and accelerates the development of new treatment modalities. Recent reports indicate that the neuromodulation market is expected to reach USD 8 billion by 2025, highlighting the growing interest in this field. As research continues to unveil the benefits of vagal nerve stimulation for various conditions, the market is poised for significant growth. The ongoing exploration of new applications for vagal nerve stimulation may further expand its market presence.

Rising Demand for Non-Pharmacological Treatment Options

The growing demand for non-pharmacological treatment options is a significant driver of the Vagal Nerve Stimulation Market. Patients and healthcare providers are increasingly seeking alternatives to traditional pharmacological therapies due to concerns over side effects and long-term dependency. Vagal nerve stimulation offers a non-invasive approach that can complement or replace medication for certain conditions. The market is likely to benefit from this shift in patient preferences, as more individuals seek holistic and integrative treatment strategies. Additionally, the increasing focus on personalized medicine is expected to enhance the appeal of vagal nerve stimulation, as it can be tailored to individual patient needs. This trend may lead to a broader acceptance and utilization of vagal nerve stimulation therapies in various healthcare settings.

Technological Innovations in Vagal Nerve Stimulation Devices

Technological advancements in vagal nerve stimulation devices are significantly influencing the Vagal Nerve Stimulation Market. Recent innovations have led to the development of more efficient, minimally invasive devices that enhance patient comfort and treatment efficacy. For instance, the introduction of closed-loop systems allows for real-time monitoring and adjustment of stimulation parameters, improving therapeutic outcomes. The market is projected to grow as these advanced devices become more widely adopted in clinical settings. Additionally, the integration of smart technologies, such as mobile applications for patient management, is expected to further drive market growth. As healthcare providers increasingly recognize the benefits of these innovations, the demand for advanced vagal nerve stimulation solutions is likely to rise.

Growing Acceptance of Vagal Nerve Stimulation in Clinical Practice

The increasing acceptance of vagal nerve stimulation as a legitimate treatment option in clinical practice is driving the Vagal Nerve Stimulation Market. Healthcare professionals are becoming more familiar with the benefits and applications of this therapy, leading to its integration into treatment protocols for conditions such as epilepsy and depression. Clinical guidelines are evolving to include vagal nerve stimulation as a recommended option, which enhances its credibility among practitioners. As more clinical studies validate its efficacy, the adoption rate is expected to rise. This trend indicates a shift in treatment paradigms, where vagal nerve stimulation is recognized as a valuable tool in managing complex neurological disorders, thereby expanding its market reach.