Top Industry Leaders in the Used Serviceable Material Market

Strategies Adopted: Key players in the USM Market employ various strategies to maintain their competitive edge and capitalize on market opportunities. These strategies include:

Inventory Optimization: Companies focus on acquiring, refurbishing, and reselling aircraft parts and components with high demand and short lead times, optimizing inventory levels to meet customer requirements and minimize storage costs.

Strategic Partnerships: Collaborations with airlines, maintenance providers, OEMs (Original Equipment Manufacturers), and leasing companies enable companies to access surplus inventory, secure consignment agreements, and expand their product portfolio, providing customers with a comprehensive range of USM solutions.

Quality Assurance: Companies implement rigorous inspection, testing, and certification processes to ensure the quality, airworthiness, and traceability of USM products, complying with regulatory standards and customer specifications to build trust and confidence among aviation stakeholders.

Market Intelligence: Companies leverage data analytics, market research, and forecasting techniques to identify emerging trends, customer preferences, and demand patterns, enabling informed decision-making, strategic pricing, and inventory management in the dynamic USM Market.

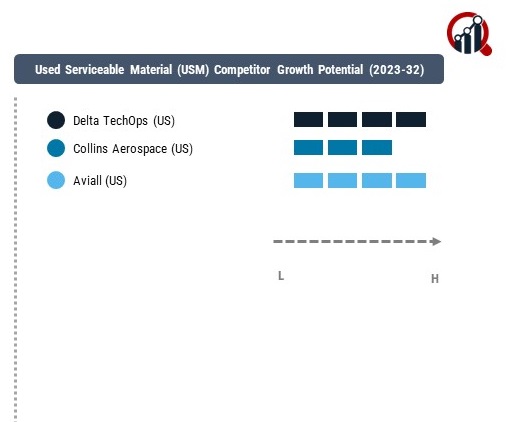

Key Companies in the used serviceable material (USM) market include

Delta TechOps (US)

Collins Aerospace (US)

Aviall (US)

Factors for Market Share Analysis: Several factors contribute to the analysis of market share in the USM Market, including:

Product Availability: The availability, diversity, and condition of USM inventory play a critical role in determining market share, with companies offering a wide selection of high-quality, certified parts and components for various aircraft types and models gaining a competitive advantage.

Pricing Competitiveness: Competitive pricing, flexible payment terms, and value-added services, such as warranty coverage, repair management, and consignment programs, influence market share by addressing cost concerns and providing cost-effective solutions to customers.

Customer Relationships: Strong relationships with airlines, MRO (Maintenance, Repair, and Overhaul) providers, lessors, and OEMs are essential for gaining market share, with companies offering responsive customer support, technical expertise, and personalized services gaining loyalty and repeat business.

Regulatory Compliance: Compliance with aviation regulations, airworthiness directives, and industry standards, such as FAA (Federal Aviation Administration) regulations and EASA (European Union Aviation Safety Agency) guidelines, is critical for gaining market share and ensuring product integrity, safety, and reliability in the USM Market.

New and Emerging Companies: In addition to established players, new and emerging companies are entering the USM Market, bringing innovative business models, technology solutions, and customer-centric approaches. Some notable new and emerging companies in the market include:

AeroTurbine, Inc.

PlaneSense, Inc.

Topcast Aviation Supplies Co., Ltd.

Global Parts Support, LLC

Aerotek Aviation Engineering Ltd.

Summit Aerospace Inc.

VAS Aero Services

ComAv Asset Management LLC

Red Aviation

Aircraft Parts Store

Industry News and Current Investment Trends: Recent developments and investment trends in the USM Market reflect a growing interest in sustainability, digitalization, and aftermarket services. Key highlights include:

Sustainable Practices: Companies are adopting environmentally friendly practices, such as component recycling, material repurposing, and carbon offset initiatives, to minimize waste, reduce environmental impact, and meet corporate social responsibility (CSR) goals in the USM Market.

Digital Transformation: Adoption of digital platforms, e-commerce solutions, and inventory management systems enables companies to streamline procurement, sales, and logistics processes, enhancing operational efficiency, transparency, and customer engagement in the USM Market.

Expansion Strategies: Companies are expanding their geographic footprint, market reach, and product offerings through acquisitions, joint ventures, and strategic alliances, consolidating market share, and diversifying revenue streams in the competitive USM Market.

Overall Competitive Scenario: The Used Serviceable Material (USM) Market is highly competitive, driven by product quality, pricing competitiveness, customer relationships, and regulatory compliance. Established players leverage their experience, infrastructure, and industry partnerships to maintain market leadership, while new entrants disrupt the market with innovative solutions and agile strategies. As the demand for cost-effective, sustainable aircraft parts and components continues to grow, companies that focus on quality assurance, customer satisfaction, and digital innovation will thrive in the competitive landscape of the USM Market.

Used Serviceable Material (USM) Industry Developments

November 2019:

The True Choice; Overhaul contract between SAFAIR and GE Aviation for the upkeep, repair, and overhaul of the CFM56-7B engines that drive its Boeing 737-800 planes fleet was extended and enlarged. Throughout the arrangement, the new one is worth more than $70 million (USD).

October 2019:

AFI KLM E&M is establishing a specialized business to find airplanes and manage their dismantling so that the assets recovered may be used to assist its maintenance operations.