Global Supply Chain Disruptions

The GCC Used Serviceable Material Market is also being shaped by global supply chain disruptions that have prompted businesses to reconsider their sourcing strategies. As international supply chains face challenges, including transportation delays and material shortages, companies in the GCC are turning to local sources of used serviceable materials. This shift not only mitigates risks associated with global sourcing but also supports local economies. The increased reliance on used materials is likely to foster a more resilient market structure within the GCC, as businesses adapt to changing global dynamics while capitalizing on the benefits of locally sourced materials.

Government Support and Initiatives

Government policies in the GCC region are increasingly favoring the adoption of used serviceable materials, thereby bolstering the GCC Used Serviceable Material Market. Initiatives aimed at promoting recycling and waste reduction are being implemented across member states, with various incentives for businesses that engage in sustainable practices. For example, the UAE has introduced regulations that encourage the use of recycled materials in construction projects, which has led to a marked increase in the availability of used serviceable materials. This supportive regulatory environment not only enhances market growth but also aligns with the broader objectives of economic diversification and environmental sustainability within the GCC.

Rising Demand for Cost-Effective Solutions

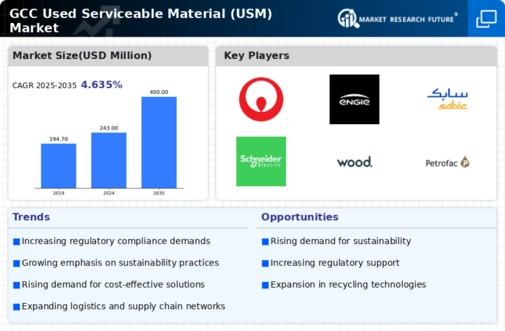

The GCC Used Serviceable Material Market is experiencing a notable increase in demand for cost-effective solutions across various sectors. As businesses seek to optimize their operational expenditures, the utilization of used serviceable materials has emerged as a viable alternative to new products. This trend is particularly evident in industries such as construction and manufacturing, where the cost of raw materials has surged. For instance, the construction sector in the GCC has reported a significant rise in the adoption of recycled materials, which has been driven by both economic considerations and sustainability goals. The GCC Used Serviceable Material Market is thus positioned to benefit from this shift, as companies increasingly prioritize budget-friendly options without compromising on quality.

Increased Awareness of Environmental Impact

There is a growing awareness of the environmental impact associated with waste and resource consumption, which is significantly influencing the GCC Used Serviceable Material Market. As consumers and businesses become more environmentally conscious, the demand for sustainable practices is on the rise. This shift is prompting companies to explore the benefits of using used serviceable materials as a means to reduce their carbon footprint. The GCC region, with its unique environmental challenges, is particularly sensitive to these issues. Consequently, businesses are increasingly integrating used materials into their supply chains, thereby contributing to a circular economy and enhancing their corporate social responsibility profiles.

Technological Innovations in Material Processing

Technological advancements in material processing are playing a crucial role in shaping the GCC Used Serviceable Material Market. Innovations such as advanced sorting and recycling technologies have improved the efficiency and quality of used materials, making them more appealing to manufacturers and consumers alike. For instance, the introduction of automated sorting systems has enabled better separation of materials, thus enhancing the overall quality of recycled products. This has led to a growing acceptance of used serviceable materials in various applications, including automotive and electronics. As technology continues to evolve, the GCC Used Serviceable Material Market is likely to witness further enhancements in material recovery and processing capabilities.