Regulatory Framework Enhancements

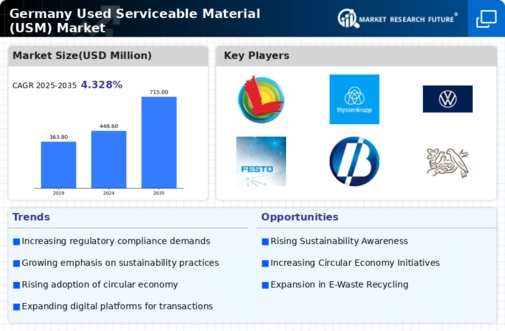

The Germany Used Serviceable Material Market is experiencing a robust transformation due to stringent regulatory frameworks aimed at promoting sustainability. The German government has implemented various policies that encourage the recycling and reuse of materials, thereby reducing waste. For instance, the Circular Economy Act mandates that businesses prioritize the use of recycled materials. This regulatory environment not only fosters innovation in material recovery but also enhances the competitiveness of companies engaged in the used serviceable material sector. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years, driven by compliance with these regulations.

Economic Incentives for Recycling Initiatives

Economic incentives provided by the German government are significantly impacting the Germany Used Serviceable Material Market. Programs that offer financial support for recycling initiatives encourage businesses to invest in the recovery and reuse of materials. For instance, subsidies for companies that implement recycling technologies or participate in material recovery programs have been instrumental in fostering a circular economy. These incentives not only lower the financial barriers for businesses but also stimulate innovation in the sector. As a result, the market is expected to expand, with projections indicating a potential increase in the volume of used serviceable materials processed by 15% over the next few years.

Rising Industrial Demand for Recycled Materials

The Germany Used Serviceable Material Market is witnessing a surge in demand from various industrial sectors that are increasingly adopting recycled materials. Industries such as automotive, construction, and electronics are actively seeking used serviceable materials to meet their production needs while adhering to sustainability goals. In 2025, it was reported that approximately 30% of raw materials used in the automotive sector were sourced from recycled materials. This trend indicates a growing recognition of the economic and environmental benefits associated with using recycled inputs, thereby propelling the growth of the used serviceable material market in Germany.

Technological Innovations in Material Processing

Technological advancements play a pivotal role in shaping the Germany Used Serviceable Material Market. Innovations in material processing technologies, such as advanced sorting and recycling techniques, have significantly improved the efficiency of material recovery. For example, the introduction of AI-driven sorting systems has enhanced the accuracy of separating recyclable materials from waste. This not only increases the volume of serviceable materials available for reuse but also reduces operational costs for businesses. As these technologies continue to evolve, they are expected to further stimulate market growth, potentially increasing the recovery rates of used materials by up to 20% in the coming years.

Consumer Awareness and Preference for Sustainability

The Germany Used Serviceable Material Market is increasingly influenced by consumer awareness regarding sustainability. As consumers become more educated about the environmental impacts of their purchasing decisions, there is a notable shift towards products made from recycled materials. Surveys indicate that over 60% of German consumers prefer brands that demonstrate a commitment to sustainability. This consumer preference is driving manufacturers to incorporate used serviceable materials into their products, thereby expanding the market. Companies that align their offerings with these consumer values are likely to gain a competitive edge, further propelling the growth of the used serviceable material market.