Rising Demand for Network Flexibility

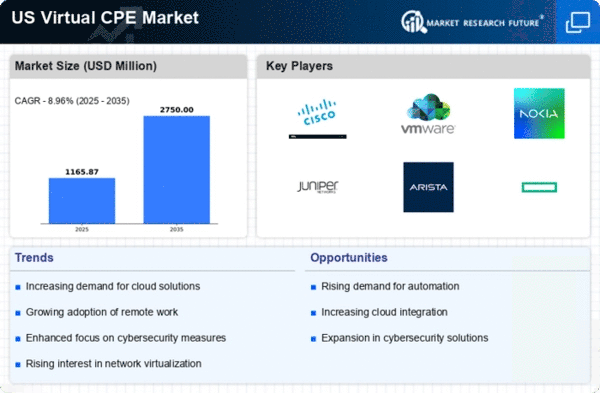

The virtual cpe market is experiencing a notable surge in demand for network flexibility. Organizations are increasingly seeking solutions that allow for rapid deployment and scalability of network services. This shift is driven by the need to adapt to changing business environments and customer expectations. According to recent data, the market for virtual CPE solutions is projected to grow at a CAGR of approximately 15% over the next five years. This growth indicates a strong preference for virtualized solutions that can be easily integrated into existing infrastructures. As businesses prioritize agility, the virtual cpe market is likely to benefit from this trend, as companies look to enhance their operational efficiency and reduce costs associated with traditional hardware deployments.

Cost Efficiency and Operational Savings

Cost efficiency remains a critical driver in the virtual cpe market. Organizations are increasingly recognizing the financial benefits associated with virtualized solutions, which often require lower capital expenditures compared to traditional hardware. By leveraging virtual CPE, companies can reduce their overall operational costs, as these solutions typically require less maintenance and can be managed remotely. Recent analyses suggest that businesses can save up to 30% on their networking costs by transitioning to virtualized services. This financial incentive is compelling for many organizations, particularly in a competitive landscape where cost management is paramount. As a result, the virtual cpe market is likely to see continued growth as more companies seek to optimize their budgets while maintaining robust network capabilities.

Increased Focus on Remote Work Solutions

The shift towards remote work has significantly impacted the virtual cpe market. As organizations adapt to a more distributed workforce, the demand for reliable and secure network solutions has intensified. Virtual CPE offers the flexibility and scalability needed to support remote operations, allowing employees to access corporate resources securely from various locations. This trend is expected to continue, with a projected increase in remote work arrangements over the coming years. Companies are likely to invest in virtual CPE solutions to ensure seamless connectivity and maintain productivity. Consequently, the virtual cpe market is poised for growth as businesses prioritize solutions that facilitate remote work while ensuring robust security and performance.

Regulatory Compliance and Security Standards

Regulatory compliance is becoming increasingly important in the virtual cpe market. Organizations are required to adhere to various security standards and regulations, which can be complex and challenging to navigate. Virtual CPE solutions often provide built-in compliance features that help organizations meet these requirements more efficiently. As data privacy laws and industry regulations evolve, the demand for compliant virtual CPE solutions is likely to rise. This trend suggests that companies will prioritize solutions that not only enhance their network capabilities but also ensure adherence to regulatory standards. As a result, the virtual cpe market may experience growth driven by the need for secure and compliant networking solutions.

Technological Advancements in Virtualization

Technological advancements play a pivotal role in shaping the virtual cpe market. Innovations in virtualization technologies, such as software-defined networking (SDN) and network function virtualization (NFV), are enhancing the capabilities of virtual CPE solutions. These advancements enable more efficient resource allocation and improved network performance, which are essential for modern enterprises. The integration of artificial intelligence and machine learning into these solutions is also gaining traction, allowing for smarter network management and predictive analytics. As these technologies evolve, they are likely to drive further adoption of virtual CPE solutions, as organizations seek to leverage cutting-edge tools to enhance their operational efficiency and service delivery in the virtual cpe market.