Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver for the virtual cpe market in France. Organizations are continuously seeking ways to reduce operational expenses while maintaining high-quality service delivery. The virtual cpe market is responding to this demand by providing solutions that minimize hardware costs and streamline network management. Recent studies indicate that businesses can achieve up to 30% savings in operational costs by transitioning to virtualized solutions. This focus on cost efficiency is likely to encourage more enterprises to adopt virtual cpe solutions, as they seek to balance performance with budget constraints. The potential for significant savings positions the virtual cpe market favorably in the eyes of cost-conscious organizations.

Rising Demand for Network Flexibility

The virtual cpe market in France experiences a notable surge in demand for network flexibility. Enterprises are increasingly seeking solutions that allow for rapid deployment and scalability of network services. This trend is driven by the need for businesses to adapt to changing market conditions and customer requirements. According to recent data, approximately 65% of French companies are prioritizing flexible network solutions to enhance operational efficiency. The virtual cpe market is responding by offering innovative solutions that enable seamless integration with existing infrastructure, thereby reducing downtime and operational costs. This growing emphasis on flexibility is likely to propel the market forward, as organizations recognize the value of agile network management in a competitive landscape.

Regulatory Compliance and Data Protection

Regulatory compliance is becoming increasingly vital for the virtual cpe market in France. With stringent data protection laws such as GDPR, organizations are compelled to adopt solutions that ensure compliance while maintaining operational efficiency. The virtual cpe market is adapting to these regulatory requirements by offering solutions that integrate compliance features into their offerings. This focus on data protection is likely to drive growth, as businesses prioritize secure and compliant network solutions. Recent surveys indicate that over 60% of French companies view compliance as a top priority, which may lead to increased investments in virtual cpe technologies that align with regulatory standards. This trend underscores the importance of compliance in shaping the future of the market.

Advancements in Virtualization Technologies

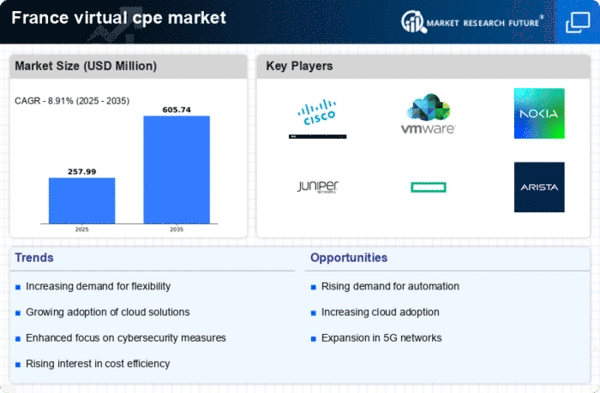

Technological advancements in virtualization are significantly influencing the virtual cpe market in France. Innovations in software-defined networking (SDN) and network functions virtualization (NFV) are enabling service providers to deliver more efficient and cost-effective solutions. The market is projected to grow at a CAGR of 12% over the next five years, driven by these advancements. As organizations increasingly adopt these technologies, they are able to optimize resource utilization and enhance service delivery. The virtual cpe market is witnessing a shift towards more sophisticated solutions that leverage these technologies, allowing for improved performance and reduced operational costs. This trend indicates a strong future for virtualization in the French market.

Growing Importance of Remote Work Solutions

The rise of remote work has created a substantial impact on the virtual cpe market in France. As companies adapt to hybrid work models, the demand for reliable and secure network solutions has intensified. The virtual cpe market is witnessing an increase in offerings tailored to support remote work environments, ensuring that employees can access necessary resources securely from various locations. Approximately 70% of French businesses are investing in technologies that facilitate remote work, highlighting the importance of robust network solutions. This trend is likely to drive further innovation within the market, as providers develop solutions that cater specifically to the needs of remote workers, enhancing productivity and collaboration.