Us Underground Mining Equipment Industry Size

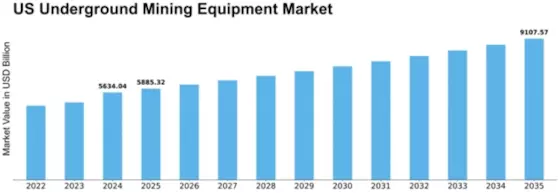

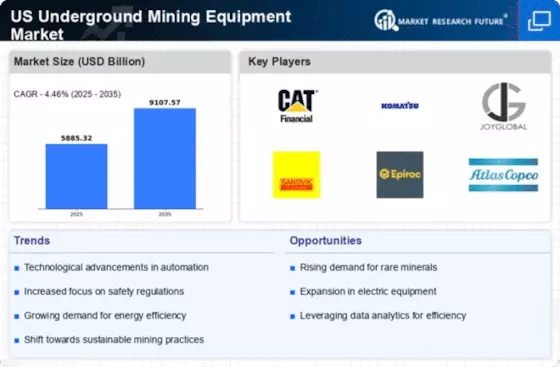

US Underground Mining Equipment Industry Growth Projections and Opportunities

The US underground mining equipment market is concerned with numerous market forces that combine to shape its dynamism. One of the most important factors is the demand for minerals and resources, as this form of machinery is majorly used in extracting valuable substances from below the earth's surface. In addition, regulatory frameworks have a significant impact on the US underground mining equipment industry. Governmental policies regarding environmental protection, safety standards, and mining practices can determine what type of machines firms should use. On this matter, more stringent guidelines may stimulate the acquisition of more advanced environmentally friendly equipment as mining entities strive to conform to ever-changing legal parameters. Conversely, the relaxation of regulations might trigger growth in this sector if compliance costs for miners are reduced. Moreover, technological advancements represent another key market factor. The dynamic nature of mining equipment technology, which is constantly advancing due to such things as automation, artificial intelligence, and sophisticated sensors, has enhanced safety, efficiency, and productivity in underground mines. Environmental considerations also play a critical role in shaping the market for underground mining gear. Infrastructure development is also a vital driver for changes in the underground mining equipment industry. The expansion of mining projects depends heavily on available infrastructure, including transport networks and power supply, particularly in remote or previously inaccessible areas. New opportunities for mining operations may be created through government initiatives or private sector investments in infrastructure, thereby increasing demand for underground mining equipment. The financial landscape and investment climate are critical determinants of industry trajectory. Access to financing by miners, either through traditional sources or otherwise, influences their ability to acquire new machinery and expand their production capacities. The underground mining equipment industry can also be affected by global market dynamics. International demand for minerals and resources or competition from foreign manufacturers can shape national markets. In contrast, many countries view environmental and social concerns as the most important factors when purchasing these types of industrial machines. Taking stakeholder expectations into account concerning sustainable and responsible resource extraction methods can influence brand reputation over procurement decisions. Companies making choices about eco-consciousness and social responsibility may profit by securing a competitive advantage in the market, which would promote the use of greener mining equipment.

Leave a Comment