Market Analysis

In-depth Analysis of US Underground Mining Equipment Industry Industry Landscape

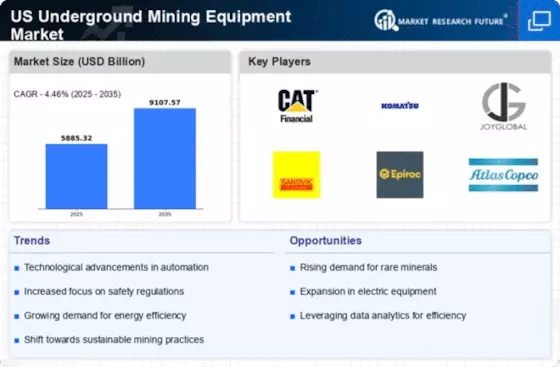

The US underground mining equipment industry operates within a dynamic and evolving market characterized by supply chain factors as well as business environment conditions affecting demand patterns. One key driver of market dynamics is constant technological advancements in mining equipment. As new technologies emerge, like advanced sensors, automation, and data analytics, miners are motivated to invest more in upgrading existing tools so as to enhance efficiency, safety, and productivity. These dynamics are also reflected through general health associated with this particular sector, such as fluctuation of prices for metals, specifically metals & minerals plus commodities contents within them. Economic factors such as inflation rates play heavily on how much money individuals have available at any given period, which affects their spending behavior, including those involving mining. Government regulations and environmental considerations also affect market dynamics within the US underground mining equipment industry. Some of the cleanest and most efficient technologies have replaced conventional ones after strict environmental rules were enacted in favor of sustainable mining practices. This transition towards green equipment has seen manufacturers aligning their offerings with these regulatory requirements. Furthermore, the US underground mining equipment market encompasses a wide array of participants, ranging from large multinationals to medium-sized operators and specialized suppliers. The rivalry among suppliers is characterized by amalgamations and takeovers, strategic partnerships, and collaborations, as firms aim to enhance their competitive advantage while boosting their product lines. This has been a trend toward consolidation as businesses seek to exploit synergies, access new markets, and realize economies of scale. Customer preference and operational requirements are also vital factors influencing market dynamics in this industry. Mining companies prioritize equipment that offers high reliability, durability, and ease of maintenance to ensure continuous and efficient operations. Consequently, manufacturers need to understand specific customer needs as well as customize products so that they can deliver on these demands efficiently.

Leave a Comment