Top Industry Leaders in the US Underground Mining Equipment Industry

The US underground mining equipment industry is a complex and competitive landscape, with a mix of established players and emerging startups vying for market share. The market is driven by a number of factors, including the global demand for minerals and metals, the cost of equipment, and the availability of skilled labor.

List of Strategies Adopted:

-

Product innovation: Leading players are investing heavily in research and development to create new and improved equipment that is more efficient, productive, and safe. This includes developing equipment with autonomous capabilities and electric motors. -

Geographic expansion: Companies are expanding their operations into new geographic markets, particularly in regions with growing mining activity. This allows them to tap into new customer segments and diversify their revenue streams. -

Mergers and acquisitions: Companies are engaging in mergers and acquisitions to consolidate market share and expand their product offerings. This can give them access to new technologies, resources, and distribution channels. -

Partnerships and joint ventures: Companies are collaborating with other firms to develop new technologies, share resources, and enter new markets. This can help them to reduce costs, accelerate innovation, and gain a competitive edge. -

Focus on sustainability: Companies are increasingly focusing on developing and offering sustainable equipment that reduces environmental impact and improves safety. This is becoming a key differentiator in the market.

Factors for Market Share:

-

Brand recognition: Established players with strong brand recognition have an advantage in the market. -

Product quality and reliability: Customers are looking for equipment that is reliable, durable, and easy to maintain. -

Customer service: Companies that provide excellent customer service can build strong relationships with their customers and retain their business. -

Pricing strategy: Companies need to offer competitive pricing in order to win market share. -

Distribution network: A strong distribution network can help companies reach a wider customer base.

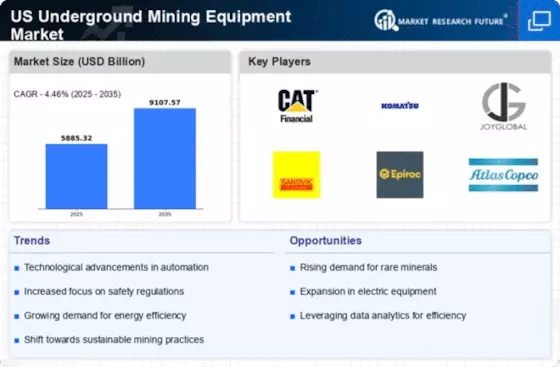

Key Players

The key players of US Underground Mining Equipment Industry report include- Komatsu Ltd, Caterpillar Inc., Joy Global Inc., Sandvik AB, Volvo AB, Hitachi Construction Machinery Co. Ltd., Doosan Infracore Co. Ltd., Boart Longyear Ltd., Flsmidth Group, Kennametal, Inc., Liebherr - International Deutschland Gmbh, Metso Corporation, and Thyssenkrupp AG.

Current Recent Developments:

October 2023: Caterpillar Inc. announced the launch of its new R3000G underground loader, designed for high-performance loading and hauling in underground mines.

September 2023: Komatsu Ltd. announced a partnership with ABB Ltd. to develop and supply electric-powered underground mining equipment.

August 2023: Sandvik AB announced the acquisition of Artisan Vehicle Systems, a US-based manufacturer of specialized underground mining vehicles.