Emergence of Advanced Analytics

The integration of advanced analytics into synthetic monitoring solutions is becoming a key driver in the market. Organizations are seeking to leverage data analytics to gain deeper insights into application performance and user behavior. By utilizing advanced analytics, businesses can proactively identify potential issues and optimize their applications accordingly. The synthetic monitoring market is likely to benefit from this trend, as companies increasingly demand solutions that not only monitor performance but also provide actionable insights. It is estimated that the adoption of analytics-driven monitoring tools could enhance operational efficiency by up to 25%.

Integration of Cloud-Based Solutions

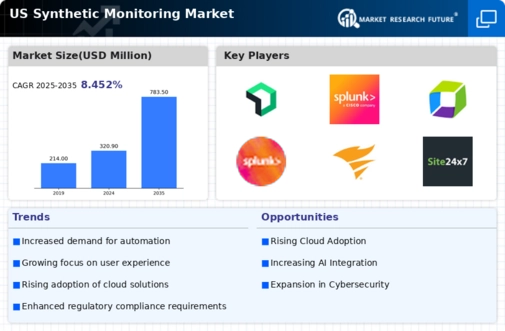

The shift towards cloud computing is significantly influencing the synthetic monitoring market. As organizations migrate their operations to the cloud, the need for effective monitoring solutions that can operate seamlessly in cloud environments becomes paramount. Cloud-based synthetic monitoring tools offer scalability and flexibility, allowing businesses to monitor applications across multiple platforms. Recent statistics indicate that the cloud segment is expected to account for over 50% of the synthetic monitoring market by 2026. This trend suggests that as more companies adopt cloud technologies, the demand for synthetic monitoring solutions tailored for cloud environments will likely increase.

Growing Focus on Digital Transformation

Digital transformation initiatives are reshaping the landscape of the synthetic monitoring market. Organizations are increasingly investing in digital tools and technologies to enhance operational efficiency and customer engagement. This transformation necessitates robust monitoring solutions to ensure that digital applications function correctly and deliver a seamless user experience. Data indicates that companies prioritizing digital transformation are likely to allocate up to 40% of their IT budgets to monitoring solutions. Consequently, the synthetic monitoring market is poised for growth as businesses seek to implement comprehensive monitoring strategies that align with their digital transformation goals.

Increased Investment in IT Infrastructure

The synthetic monitoring market is witnessing a rise in investments directed towards IT infrastructure. As organizations recognize the critical role of technology in driving business success, they are allocating more resources to enhance their IT capabilities. This trend is particularly evident in sectors such as finance and e-commerce, where reliable application performance is essential. Recent reports suggest that IT spending in these sectors is projected to grow by 5% annually, with a significant portion earmarked for monitoring solutions. This increased investment is likely to bolster the synthetic monitoring market, as businesses seek to ensure their IT infrastructure can support their operational needs.

Rising Demand for Performance Optimization

The synthetic monitoring market is experiencing a notable surge in demand for performance optimization solutions. Organizations are increasingly recognizing the necessity of ensuring their applications perform optimally under various conditions. This trend is driven by the need to enhance user satisfaction and retention rates. According to recent data, companies that implement synthetic monitoring solutions can achieve up to a 30% improvement in application performance. As businesses strive to maintain competitive advantages, the synthetic monitoring market is likely to see continued growth, with investments in performance optimization tools becoming a priority for many enterprises.