Expansion of E-Commerce Platforms

The expansion of e-commerce platforms in the GCC is significantly influencing the synthetic monitoring market. As more businesses transition to online sales channels, the need for robust monitoring solutions becomes critical to ensure seamless user experiences. E-commerce companies are particularly vulnerable to performance issues, which can lead to lost revenue and customer dissatisfaction. The synthetic monitoring market is poised to grow as these businesses seek to implement comprehensive monitoring strategies that can identify and resolve performance bottlenecks. Recent estimates suggest that the e-commerce sector in the GCC could reach a valuation of $28 billion by 2026, further driving the demand for effective synthetic monitoring solutions to support this growth.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the synthetic monitoring market is transforming how organizations approach performance management. AI-driven solutions offer advanced analytics capabilities, enabling businesses to predict potential issues before they impact users. This proactive approach is particularly valuable in the GCC, where rapid digital transformation is occurring. The synthetic monitoring market is likely to benefit from AI's ability to analyze vast amounts of data, providing actionable insights that enhance decision-making processes. As organizations in the GCC continue to adopt AI technologies, the demand for synthetic monitoring solutions that leverage these advancements is expected to rise, potentially increasing market growth by an estimated 20% over the next few years.

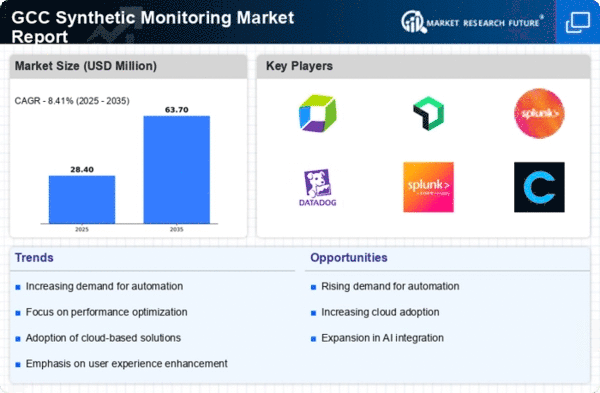

Rising Demand for Performance Monitoring

The The market is experiencing a notable surge in demand for performance monitoring solutions across various sectors in the GCC. is experiencing a notable surge in demand for performance monitoring solutions across various sectors in the GCC. Organizations are increasingly recognizing the necessity of ensuring optimal application performance and user experience. This trend is driven by the growing reliance on digital platforms, which has led to a heightened focus on application reliability. According to recent data, the synthetic monitoring market is projected to grow at a CAGR of approximately 15% in the GCC region over the next five years. This growth is indicative of the increasing investments in performance monitoring tools that provide real-time insights into application behavior, thereby enhancing operational efficiency and customer satisfaction.

Increased Focus on Digital Transformation

The ongoing digital transformation initiatives across various industries in the GCC are propelling the synthetic monitoring market forward. Organizations are increasingly adopting digital technologies to enhance operational efficiency and customer engagement. This shift necessitates the implementation of synthetic monitoring solutions to ensure that digital applications perform optimally. As businesses invest in digital tools, the synthetic monitoring market is likely to see a corresponding increase in demand for solutions that provide insights into application performance and user experience. The market is expected to grow by approximately 18% in the next few years, reflecting the critical role that synthetic monitoring plays in supporting digital transformation efforts.

Growing Importance of Data Privacy Regulations

The growing importance of data privacy regulations in the GCC is shaping the synthetic monitoring market landscape. As governments implement stricter data protection laws, organizations are compelled to ensure compliance while maintaining high performance standards. This regulatory environment drives the need for synthetic monitoring solutions that can help businesses monitor their applications for compliance with data privacy requirements. The synthetic monitoring market is likely to expand as organizations seek tools that not only enhance performance but also ensure adherence to regulatory standards. With the increasing focus on data privacy, the market could witness a growth rate of around 12% in the coming years, as companies prioritize compliance alongside performance monitoring.