Increased Need for Data Security

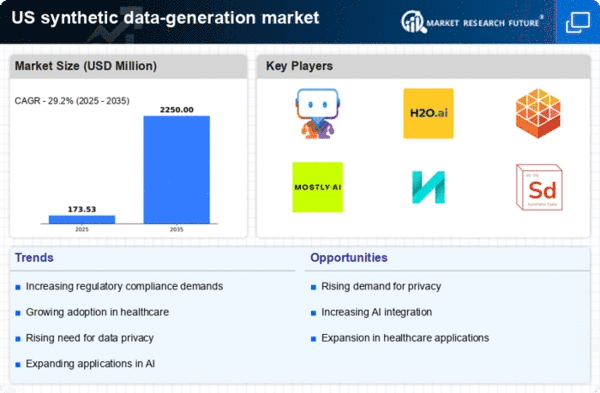

The synthetic data-generation market is experiencing a surge in demand due to the heightened focus on data security. Organizations are increasingly recognizing the importance of protecting sensitive information while still being able to utilize data for analysis and model training. This trend is particularly pronounced in sectors such as finance and healthcare, where data breaches can lead to significant financial losses and reputational damage. The market was projected to grow at a CAGR of approximately 25% over the next five years, driven by the need for secure data solutions. As companies seek to comply with stringent regulations, the synthetic data-generation market is positioned to provide innovative solutions that allow for data utilization without compromising privacy.

Enhanced Data Quality and Diversity

The synthetic data-generation market is characterized by its ability to produce high-quality and diverse datasets, which is increasingly recognized as a critical factor for successful machine learning applications. Traditional datasets often suffer from biases and limitations that can hinder model performance. In contrast, synthetic data can be engineered to include a wide range of scenarios and variations, thereby improving the robustness of AI models. This capability is particularly valuable in industries such as healthcare, where diverse data is essential for accurate diagnostics and treatment predictions. As organizations strive for better model accuracy, the synthetic data-generation market is likely to see continued growth, driven by the demand for superior data quality.

Growing Adoption of AI Technologies

The synthetic data-generation market is benefiting from the rapid adoption of artificial intelligence (AI) technologies across various industries. As organizations strive to enhance their AI models, the need for high-quality training data becomes paramount. Synthetic data offers a viable solution, enabling companies to generate vast amounts of data that can be tailored to specific requirements. This is particularly relevant in sectors such as autonomous vehicles and robotics, where real-world data can be scarce or difficult to obtain. The market is expected to reach a valuation of $1 billion by 2026, reflecting the increasing reliance on synthetic data to fuel AI advancements. Consequently, the synthetic data-generation market is likely to play a crucial role in the evolution of AI applications.

Emerging Use Cases in Diverse Industries

The synthetic data-generation market is witnessing a diversification of use cases across various industries, which is driving its growth. Sectors such as finance, healthcare, and retail are increasingly leveraging synthetic data for tasks ranging from fraud detection to customer behavior analysis. For instance, financial institutions are utilizing synthetic data to simulate various market conditions, allowing for better risk assessment and decision-making. The healthcare industry is also exploring synthetic data for training machine learning models in medical imaging and diagnostics. This broadening of applications suggests that the synthetic data-generation market is not only expanding but also evolving to meet the unique needs of different sectors, potentially leading to a market size of $2 billion by 2027.

Cost-Effectiveness of Synthetic Data Solutions

The synthetic data-generation market is gaining traction due to the cost-effectiveness of synthetic data solutions compared to traditional data collection methods. Organizations often face high costs associated with data acquisition, cleaning, and storage. In contrast, synthetic data can be generated at a fraction of the cost, allowing companies to allocate resources more efficiently. This financial advantage is particularly appealing to startups and small businesses that may lack the budget for extensive data collection efforts. As the market continues to mature, the affordability of synthetic data solutions is likely to attract a broader range of customers, further propelling the growth of the synthetic data-generation market.