Rising Focus on Data Privacy

The synthetic data-generation market is being shaped by a rising focus on data privacy and security in Canada. With increasing regulations surrounding data protection, organizations are seeking ways to utilize data without compromising sensitive information. Synthetic data offers a viable solution, as it can be generated without exposing real user data, thus ensuring compliance with privacy regulations. The Canadian government has implemented stringent data protection laws, which are expected to drive the adoption of synthetic data solutions. As businesses strive to maintain compliance while leveraging data for insights, the synthetic data-generation market is likely to see substantial growth, as it provides a means to balance innovation with privacy concerns.

Emergence of Innovative Use Cases

The synthetic data-generation market is witnessing the emergence of innovative use cases across various sectors in Canada. As organizations explore new applications for synthetic data, the potential for growth in this market becomes increasingly apparent. Industries such as automotive, finance, and healthcare are leveraging synthetic data for purposes ranging from training autonomous vehicles to enhancing fraud detection systems. The versatility of synthetic data allows for experimentation and development in areas that may have previously been constrained by data availability. This trend suggests that as more organizations recognize the benefits of synthetic data, the market is likely to expand, driven by a diverse range of applications and use cases.

Need for Cost-Effective Data Solutions

The synthetic data-generation market is gaining traction due to the need for cost-effective data solutions in various industries.. Traditional data collection methods can be resource-intensive and time-consuming, often requiring significant financial investment. In contrast, synthetic data can be generated quickly and at a lower cost, making it an attractive alternative for organizations looking to optimize their data strategies. In Canada, businesses are increasingly turning to synthetic data to reduce operational costs while still obtaining high-quality datasets for analysis. This shift towards more economical data solutions is likely to drive the growth of the synthetic data-generation market, as organizations seek to maximize their return on investment in data initiatives.

Advancements in Artificial Intelligence

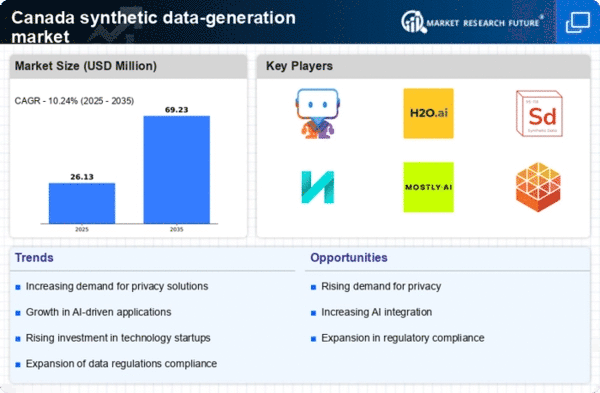

The synthetic data-generation market is significantly influenced by advancements in artificial intelligence (AI) technologies. As AI continues to evolve, the need for high-quality training data becomes increasingly critical. Synthetic data serves as a valuable resource for training machine learning models, particularly in scenarios where real data is scarce or sensitive. In Canada, the AI sector is projected to grow at a compound annual growth rate (CAGR) of 25% over the next five years, further driving the demand for synthetic data solutions. This growth indicates that organizations are likely to invest in synthetic data-generation tools to enhance their AI capabilities, thereby fostering innovation and improving overall performance in various applications.

Growing Demand for Data-Driven Insights

The synthetic data-generation market is experiencing a notable surge in demand for data-driven insights across various sectors in Canada. Organizations are increasingly recognizing the value of data analytics in decision-making processes. This trend is particularly evident in industries such as finance and retail, where data-driven strategies can lead to improved customer experiences and operational efficiencies. According to recent estimates, the market for data analytics in Canada is projected to reach approximately $5 billion by 2026, indicating a robust growth trajectory. As businesses seek to harness the power of data, the synthetic data-generation market is positioned to play a crucial role in providing high-quality, realistic datasets that can enhance analytical capabilities and drive innovation.