Rising Healthcare Expenditure

The increase in healthcare expenditure in the United States plays a crucial role in the expansion of the suture wire market. With healthcare spending projected to reach $6 trillion by 2027, there is a corresponding rise in investments in surgical technologies and materials. This financial commitment enables hospitals and surgical centers to procure advanced suture wire products, which are essential for various surgical procedures. As healthcare providers seek to improve patient outcomes and operational efficiency, the demand for high-quality suture wires is likely to grow, further driving the market's expansion.

Advancements in Suture Materials

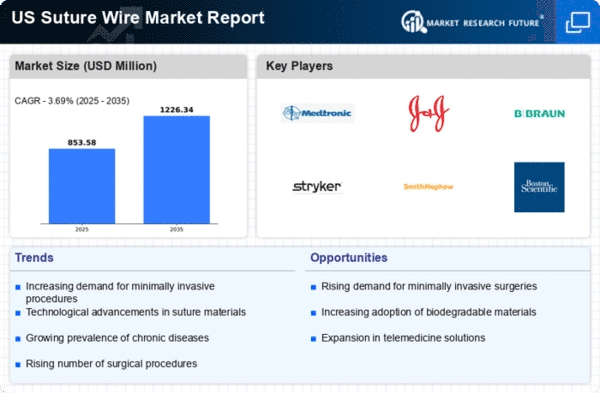

Innovations in suture materials are transforming the suture wire market, leading to the development of products that offer enhanced performance and safety. Recent advancements include the introduction of bioabsorbable sutures and antimicrobial coatings, which are designed to reduce infection rates and improve healing times. The market for these advanced suture materials is expected to expand, driven by increasing awareness among healthcare professionals regarding the benefits of using high-quality suture wires. As a result, manufacturers are likely to invest in research and development to create more effective suture solutions, thereby propelling the growth of the suture wire market.

Growth in the Elderly Population

The aging population in the United States significantly influences the suture wire market. As individuals age, they often require more surgical interventions due to various health issues, including cardiovascular diseases and orthopedic conditions. According to recent statistics, the population aged 65 and older is expected to reach 80 million by 2040, which will likely increase the demand for surgical procedures and, consequently, suture wire products. This demographic shift suggests a sustained growth trajectory for the suture wire market, as healthcare systems adapt to meet the needs of an older population requiring more frequent surgical care.

Focus on Surgical Safety and Quality

The emphasis on surgical safety and quality in the healthcare sector significantly impacts the suture wire market. Regulatory bodies and healthcare organizations are increasingly prioritizing patient safety, leading to stricter guidelines for surgical practices. This focus encourages the adoption of high-quality suture materials that meet rigorous safety standards. As hospitals and surgical centers strive to enhance their quality of care, the demand for reliable and effective suture wire products is expected to rise. Consequently, manufacturers in the suture wire market may need to align their offerings with these evolving standards to remain competitive.

Increasing Demand for Minimally Invasive Surgeries

The suture wire market experiences a notable boost due to the rising demand for minimally invasive surgeries. These procedures, which are characterized by smaller incisions and reduced recovery times, often require specialized suture materials. As healthcare providers increasingly adopt these techniques, the need for advanced suture wire solutions becomes paramount. The market for minimally invasive surgeries is projected to grow at a CAGR of approximately 10% over the next few years, indicating a robust demand for suture wire products tailored for such applications. This trend is likely to drive innovation within the suture wire market, as manufacturers strive to develop materials that enhance surgical outcomes while minimizing patient discomfort.