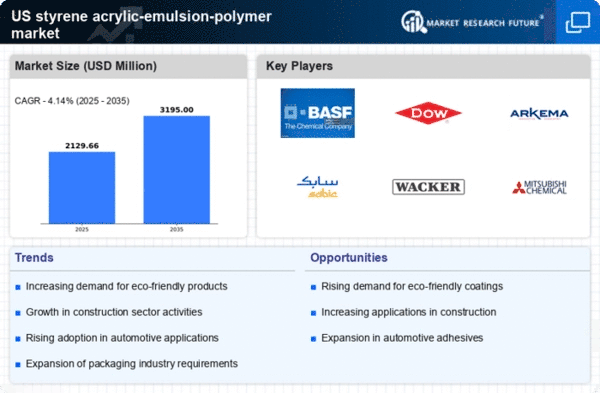

The styrene acrylic-emulsion-polymer market is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Key players such as BASF SE (Germany), Dow Inc. (US), and Arkema S.A. (France) are actively shaping the market through their distinct operational focuses. BASF SE (Germany) emphasizes sustainability in its product development, aiming to reduce environmental impact while enhancing performance. Dow Inc. (US) is leveraging digital transformation to optimize its supply chain and improve customer engagement, while Arkema S.A. (France) is pursuing strategic acquisitions to expand its product portfolio and market reach. Collectively, these strategies contribute to a competitive environment that prioritizes innovation and responsiveness to market demands.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several key players exerting influence over their respective segments. This fragmentation allows for a diverse range of products and innovations, fostering competition that drives advancements in technology and sustainability.

In September Dow Inc. (US) announced a partnership with a leading technology firm to develop AI-driven solutions for enhancing production efficiency in styrene acrylic-emulsion polymers. This strategic move is likely to position Dow at the forefront of technological innovation, enabling it to streamline operations and reduce costs, thereby enhancing its competitive edge in the market.

In October BASF SE (Germany) launched a new line of eco-friendly styrene acrylic-emulsion polymers designed for use in construction applications. This initiative underscores BASF's commitment to sustainability and aligns with growing market demand for environmentally friendly products. The introduction of these innovative solutions may strengthen BASF's market position and appeal to environmentally conscious consumers.

In August Arkema S.A. (France) completed the acquisition of a regional competitor, which is expected to enhance its production capabilities and expand its market presence in North America. This acquisition reflects Arkema's strategy to consolidate its position in the market and leverage synergies to drive growth. The integration of new technologies and expertise from the acquired company could further enhance Arkema's product offerings.

As of November current competitive trends in the styrene acrylic-emulsion-polymer market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, allowing companies to pool resources and expertise to innovate more effectively. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, as companies strive to meet the changing demands of consumers and regulatory standards.