Rise of Fitness Culture

The burgeoning fitness culture in the US is a significant catalyst for the sports nutrition market. With an increasing number of individuals engaging in regular physical activities, the demand for nutritional products that support performance and recovery is on the rise. Recent statistics indicate that over 50% of Americans participate in some form of exercise, creating a robust market for sports nutrition products. This cultural shift is further amplified by the proliferation of fitness influencers and social media platforms, which promote active lifestyles and the importance of nutrition in achieving fitness goals. Consequently, the sports nutrition market is experiencing a surge in product launches, with brands focusing on innovative solutions that cater to the needs of fitness enthusiasts. This dynamic environment encourages competition and drives continuous improvement in product offerings, ultimately benefiting consumers.

Expansion of Retail Channels

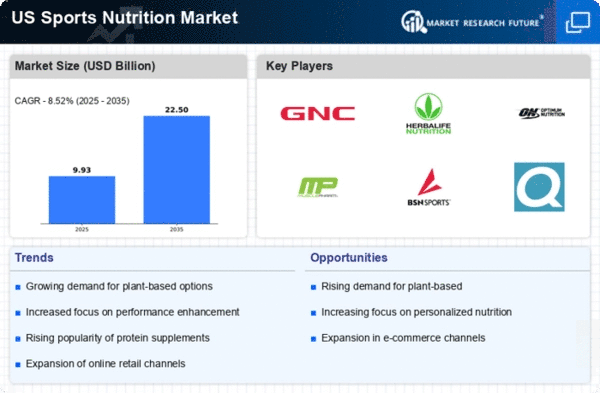

The expansion of retail channels is playing a crucial role in the growth of the sports nutrition market. Traditional brick-and-mortar stores, alongside online platforms, are increasingly offering a diverse range of sports nutrition products. This accessibility allows consumers to explore various options and make informed purchasing decisions. Recent data suggests that e-commerce sales in the sports nutrition market have grown by over 30% in the past year, reflecting a shift in consumer shopping habits. Retailers are also enhancing the in-store experience by providing knowledgeable staff and interactive displays that educate consumers about the benefits of different products. As a result, the sports nutrition market is witnessing a transformation in how products are marketed and sold, with an emphasis on convenience and consumer engagement. This trend is likely to continue, as brands seek to capitalize on the growing demand for sports nutrition solutions.

Increasing Health Consciousness

The growing awareness of health and wellness among consumers is a pivotal driver for the sports nutrition market. Individuals are increasingly prioritizing their physical fitness and nutritional intake, leading to a surge in demand for products that support athletic performance and overall health. According to recent data, approximately 70% of consumers in the US actively seek out nutritional supplements to enhance their fitness routines. This trend is particularly pronounced among millennials and Gen Z, who are more inclined to invest in health-related products. As a result, brands within the sports nutrition market are adapting their offerings to cater to this health-conscious demographic, emphasizing clean labels and scientifically-backed ingredients. The sports nutrition market is thus witnessing a transformation, with companies innovating to meet the evolving preferences of consumers who are more informed about their dietary choices.

Increased Focus on Performance Enhancement

The heightened focus on performance enhancement is a driving force behind the sports nutrition market. Athletes and fitness enthusiasts are increasingly seeking products that promise improved endurance, strength, and recovery. This trend is supported by a growing body of research that highlights the role of specific nutrients in optimizing athletic performance. For instance, protein supplements and amino acids are gaining traction among consumers looking to enhance their training outcomes. The sports nutrition market is responding to this demand by developing specialized products that cater to various athletic needs, from pre-workout energy boosters to post-workout recovery aids. As competition intensifies, brands are investing in research and development to create innovative formulations that deliver tangible results. This focus on performance is likely to drive further growth in the market, as consumers become more discerning in their choices.

Technological Advancements in Product Development

Technological innovations are significantly influencing the sports nutrition market, enabling the development of more effective and appealing products. Advances in food science and technology have led to the creation of novel formulations that enhance nutrient absorption and bioavailability. For instance, the incorporation of microencapsulation techniques allows for the targeted delivery of nutrients, improving their efficacy. Additionally, the rise of personalized nutrition, driven by data analytics and consumer insights, is reshaping product offerings. Brands are increasingly leveraging technology to create tailored solutions that meet individual dietary needs and preferences. This trend is expected to propel the sports nutrition market forward, as consumers seek products that align with their specific health goals. The integration of technology not only enhances product quality but also fosters consumer trust, as transparency in ingredient sourcing and formulation becomes paramount.