Emergence of Cloud Computing

The software engineering market is significantly influenced by the rapid adoption of cloud computing technologies. As organizations transition to cloud-based solutions, the demand for software engineering services that facilitate this shift grows. In 2025, it is estimated that cloud services will account for over 30% of IT spending in the US, underscoring the importance of cloud integration in software development. The software engineering market is adapting to this trend by focusing on developing scalable, secure, and efficient cloud applications. This shift not only enhances accessibility but also reduces operational costs for businesses, making cloud computing a pivotal driver in the software engineering landscape.

Regulatory Compliance and Standards

The software engineering market is increasingly shaped by the need for compliance with various regulatory standards. As industries face stricter regulations regarding data protection, privacy, and security, the demand for compliant software solutions rises. In 2025, it is anticipated that compliance-related software will constitute a significant portion of the software engineering market, with organizations allocating substantial budgets to ensure adherence to regulations. This trend compels software engineers to integrate compliance features into their development processes, thereby enhancing the overall quality and reliability of software products. Consequently, the focus on regulatory compliance is driving innovation and creating new opportunities within the software engineering market.

Growing Importance of Data Analytics

Data analytics has emerged as a critical driver in the software engineering market, as organizations seek to leverage data for informed decision-making. The increasing volume of data generated by businesses necessitates sophisticated software solutions that can analyze and interpret this information effectively. In 2025, the data analytics market is projected to exceed $200 billion, indicating a strong correlation with the software engineering market. Companies are investing in software engineering to develop advanced analytics tools that provide insights into customer behavior, operational efficiency, and market trends. This focus on data-driven strategies is reshaping the software engineering landscape, as firms prioritize analytics capabilities in their software development initiatives.

Increased Demand for Software Solutions

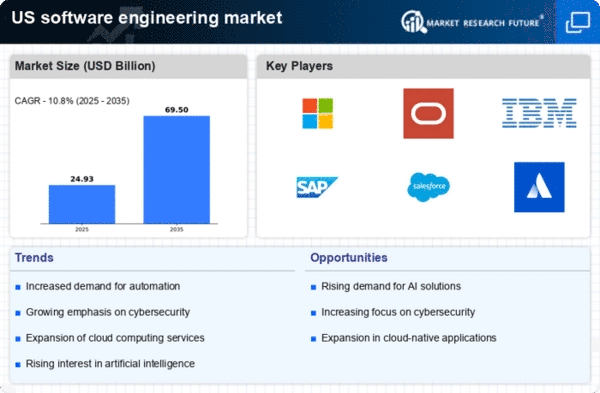

The software engineering market experiences heightened demand for innovative software solutions across various sectors. As businesses increasingly rely on technology to enhance operational efficiency, the need for custom software development rises. In 2025, the market is projected to reach approximately $500 billion, reflecting a growth rate of around 10% annually. This trend indicates that organizations are prioritizing software engineering to remain competitive. The software engineering market is thus witnessing a surge in projects aimed at digital transformation, which encompasses everything from mobile applications to enterprise software. Companies are investing heavily in software engineering talent to meet these demands, leading to a robust job market for software engineers.

Advancements in Development Tools and Technologies

The software engineering market is propelled by continuous advancements in development tools and technologies. The emergence of low-code and no-code platforms is transforming how software is developed, enabling faster and more efficient project delivery. In 2025, it is projected that the low-code development market will grow by over 25%, reflecting a shift towards democratizing software development. This trend allows non-technical users to participate in the software engineering market, thereby expanding the talent pool and accelerating innovation. As organizations seek to streamline their development processes, the adoption of these advanced tools is likely to reshape the software engineering landscape, fostering a culture of rapid prototyping and iterative development.