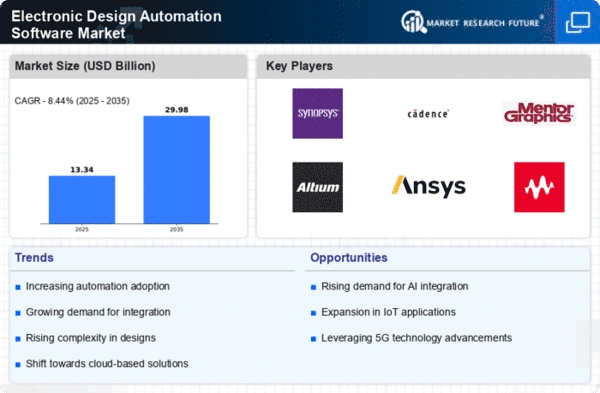

North America : Innovation and Leadership Hub

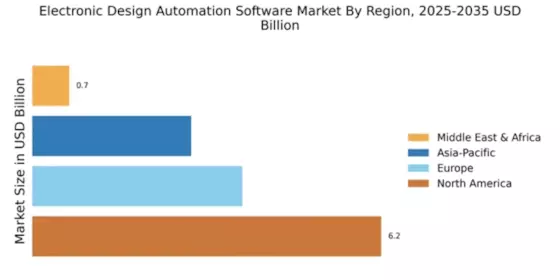

North America continues to lead the Electronic Design Automation (EDA) software market, holding a significant share of 6.15 billion in 2025. The region's growth is driven by rapid technological advancements, increasing demand for complex electronic systems, and supportive government initiatives promoting innovation. The presence of major tech companies and a robust infrastructure further catalyze market expansion, making it a focal point for EDA solutions.

The competitive landscape in North America is characterized by key players such as Synopsys, Cadence Design Systems, and Mentor Graphics, which dominate the market. These companies are continuously innovating to meet the evolving needs of industries like automotive, telecommunications, and consumer electronics. The region's strong investment in R&D and a skilled workforce contribute to its position as a global leader in EDA software development.

Europe : Emerging Market with Growth Potential

Europe's Electronic Design Automation software market is projected to reach 3.7 billion by 2025, driven by increasing investments in technology and a growing emphasis on automation across various sectors. The region is witnessing a surge in demand for EDA tools, particularly in automotive and aerospace industries, as companies strive for efficiency and innovation. Regulatory frameworks supporting digital transformation further enhance market growth prospects.

Leading countries in Europe, such as Germany, France, and the UK, are at the forefront of EDA software adoption. The competitive landscape features prominent players like Siemens EDA and Altium, which are leveraging advanced technologies to cater to diverse industry needs. The region's focus on sustainability and smart technologies is expected to propel further growth in the EDA market.

Asia-Pacific : Rapidly Growing Technology Sector

The Asia-Pacific region is experiencing rapid growth in the Electronic Design Automation software market, projected to reach 2.8 billion by 2025. This growth is fueled by increasing investments in electronics manufacturing, a rising number of startups, and government initiatives aimed at boosting technological innovation. Countries like China and India are leading this transformation, with a strong focus on developing smart technologies and enhancing manufacturing capabilities.

China, Japan, and South Korea are the key players in the Asia-Pacific EDA market, with companies like Zuken and Aldec making significant contributions. The competitive landscape is evolving, with local firms emerging alongside established global players. The region's emphasis on research and development, coupled with a growing demand for advanced electronic products, positions it as a critical player in the global EDA landscape.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa (MEA) region, while currently holding a smaller market size of 0.65 billion in the Electronic Design Automation software sector, presents significant growth opportunities. The region is witnessing an increase in technology adoption, driven by government initiatives aimed at diversifying economies and enhancing digital infrastructure. The demand for EDA solutions is expected to rise as industries such as telecommunications and automotive expand their operations.

Countries like South Africa and the UAE are leading the charge in adopting EDA technologies, with a focus on improving local manufacturing capabilities. The competitive landscape is gradually evolving, with both local and international players entering the market. As the region continues to invest in technology and innovation, the EDA market is poised for substantial growth in the coming years.