Growth in DIY Installation Options

The US Smart Doorbell Market is witnessing a significant growth in DIY installation options. As consumers seek convenience and cost-effectiveness, many are opting for smart doorbells that can be easily installed without professional assistance. Recent market analysis suggests that nearly 55% of smart doorbell sales are attributed to DIY installations. This trend is particularly appealing to tech-savvy consumers who prefer to manage their home security systems independently. Manufacturers are responding by designing user-friendly products that come with comprehensive installation guides and customer support. The rise of online tutorials and community forums further supports this trend, enabling consumers to troubleshoot issues independently. As DIY options continue to expand, the US Smart Doorbell Market is likely to experience sustained growth.

Integration with Smart Home Ecosystems

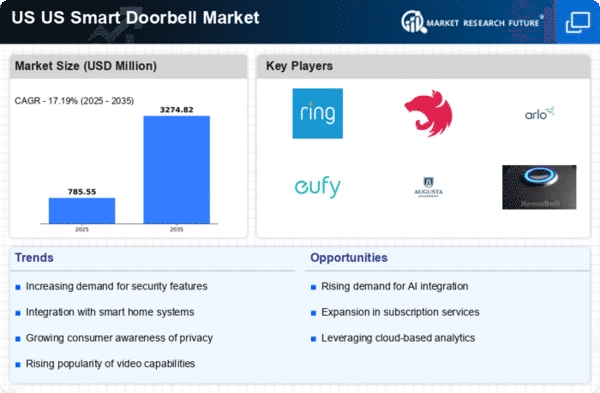

The US Smart Doorbell Market is experiencing a notable shift towards integration with broader smart home ecosystems. As consumers increasingly adopt smart home devices, the demand for doorbells that seamlessly connect with other devices, such as smart locks and security cameras, is rising. According to recent data, approximately 70% of smart doorbell users also own other smart home devices, indicating a strong correlation. This integration not only enhances user convenience but also improves overall home security. The ability to control multiple devices through a single application is appealing to consumers, thereby driving growth in the US Smart Doorbell Market. Companies that prioritize compatibility with popular platforms, such as Amazon Alexa and Google Assistant, are likely to gain a competitive edge in this evolving landscape.

Rising Demand for Enhanced Video Quality

The US Smart Doorbell Market is experiencing a rising demand for enhanced video quality. As technology advances, consumers are increasingly expecting high-definition video capabilities in their smart doorbells. Recent statistics indicate that over 75% of consumers consider video quality a critical factor when purchasing a smart doorbell. This demand is driven by the need for clear and reliable footage for security purposes. Manufacturers are responding by incorporating features such as 1080p or even 4K video resolution, night vision, and wide-angle lenses. The ability to capture detailed images can significantly enhance the effectiveness of home security systems. As competition intensifies, companies that prioritize video quality in their offerings are likely to gain a competitive advantage in the US Smart Doorbell Market.

Emphasis on Privacy and Security Features

In the US Smart Doorbell Market, there is a growing emphasis on privacy and security features. Consumers are increasingly concerned about data protection and the potential misuse of video footage. As a result, manufacturers are focusing on enhancing encryption protocols and offering features such as local storage options. Recent surveys indicate that over 60% of consumers prioritize privacy features when selecting a smart doorbell. This trend is likely to shape product development, as companies strive to build trust with their customers. Furthermore, regulatory frameworks surrounding data privacy are becoming more stringent, compelling manufacturers to adopt robust security measures. The emphasis on privacy and security is not merely a trend; it is becoming a fundamental requirement for success in the US Smart Doorbell Market.

Increased Consumer Awareness and Education

In the US Smart Doorbell Market, increased consumer awareness and education are playing a pivotal role in driving market growth. As consumers become more informed about the benefits of smart doorbells, their adoption rates are likely to rise. Educational campaigns by manufacturers and retailers are helping to demystify the technology, making it more accessible to a broader audience. Recent surveys indicate that nearly 65% of potential buyers express a desire for more information on product features and installation processes. This growing awareness is fostering a more informed consumer base, which is essential for market expansion. As educational initiatives continue to evolve, they are expected to further stimulate interest and investment in the US Smart Doorbell Market.