Emergence of Private Networks

This market is experiencing a notable emergence of private networks, particularly among enterprises seeking to enhance their operational efficiency. Organizations are increasingly recognizing the benefits of deploying dedicated small cell networks to support their specific connectivity needs. This trend is driven by the desire for improved security, control, and performance, particularly in industries such as manufacturing and logistics. By leveraging small cell technology, businesses can create tailored networks that optimize data flow and reduce latency. As the demand for private networks continues to grow, the small cell-networks market is likely to see a corresponding increase in investment and innovation, positioning it as a critical component of future connectivity solutions.

Shift Towards Smart City Initiatives

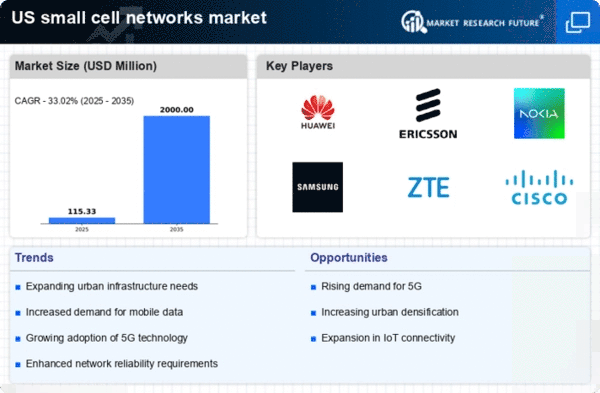

This market is significantly influenced by the ongoing shift towards smart city initiatives across the United States. Municipalities are increasingly adopting advanced technologies to enhance urban living, which necessitates the deployment of small cells to support various applications such as smart lighting, traffic management, and public safety. The integration of small cell networks into these initiatives is expected to facilitate seamless connectivity and data exchange, thereby improving overall city efficiency. As cities invest infrastructure upgrades, the small cell-networks market is poised to benefit from increased demand, with projections indicating a potential growth rate of 25% over the next five years.

Increased Focus on Network Reliability

This market is witnessing an increased focus on network reliability, driven by the growing expectations of consumers and businesses for uninterrupted connectivity. As digital transformation accelerates across various sectors, organizations are recognizing the importance of robust network infrastructure to support their operations. Small cells offer a solution to enhance network reliability by providing localized coverage and reducing latency. This trend is particularly relevant in sectors such as healthcare and finance, where downtime can have severe consequences. As a result, investments in small cell technology are expected to rise, with companies prioritizing network reliability as a key driver for growth in the small cell-networks market.

Growing Demand for Enhanced Connectivity

The small cell-networks market is experiencing a surge in demand for enhanced connectivity solutions, particularly in densely populated urban areas. As consumers increasingly rely on mobile devices for various applications, the need for reliable and high-speed internet access becomes paramount. According to recent data, approximately 80% of mobile data traffic is generated indoors, highlighting the necessity for small cell deployments to improve coverage and capacity. This trend is further fueled by the proliferation of IoT devices, which require robust network infrastructure. Consequently, service providers are investing heavily in small cell technology to meet consumer expectations and maintain competitive advantage in the market.

Rising Adoption of Mobile Video Streaming

The small cell-networks market is being propelled by the rising adoption of mobile video streaming services. With platforms like Netflix and YouTube dominating mobile data consumption, the demand for high-quality video streaming is at an all-time high. This trend necessitates the deployment of small cells to alleviate network congestion and enhance user experience. Recent statistics suggest that video streaming accounts for over 60% of mobile data traffic, underscoring the critical role of small cell technology in supporting this demand. As consumers continue to prioritize video content, service providers are likely to invest in small cell infrastructure to ensure optimal performance and customer satisfaction.