Growing Mobile Data Traffic

The small cell-networks market is being propelled by the growing mobile data traffic in South Korea. With the increasing consumption of data-intensive applications such as video streaming and online gaming, mobile operators are under pressure to enhance their network capacity. Reports indicate that mobile data traffic in South Korea is expected to grow by over 30% annually, necessitating the deployment of small cell networks to alleviate congestion and improve service quality. These networks enable operators to offload traffic from macro cells, ensuring a seamless user experience. As mobile data consumption continues to rise, the small cell-networks market is likely to benefit from the urgent need for scalable and efficient network solutions.

Rising Demand for Enhanced Connectivity

The small cell-networks market in South Korea is experiencing a surge in demand for enhanced connectivity solutions. As urban areas become increasingly congested, the need for reliable and high-speed internet access is paramount. This demand is driven by the proliferation of smart devices and the Internet of Things (IoT), which require robust network infrastructure. According to recent data, the number of connected devices in South Korea is projected to reach over 30 million by 2026, indicating a substantial market opportunity for small cell networks. These networks provide localized coverage, improving user experience and reducing latency. Consequently, the small cell-networks market is likely to expand as businesses and consumers alike seek solutions that can accommodate their growing connectivity needs.

Increased Focus on Smart City Initiatives

The small cell-networks market is significantly influenced by the increasing focus on smart city initiatives in South Korea. As urban planners and government officials prioritize the development of smart cities, the demand for advanced communication networks becomes critical. Small cell networks are essential for supporting various smart city applications, including traffic management, public safety, and environmental monitoring. The South Korean government has allocated approximately $1 billion for smart city projects, which is expected to drive the adoption of small cell technology. This investment indicates a strong commitment to enhancing urban infrastructure, thereby creating a favorable environment for the small cell-networks market to thrive.

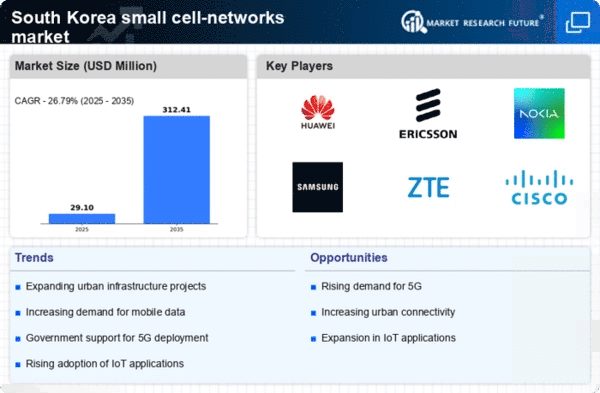

Competitive Landscape and Market Consolidation

The competitive landscape of the small cell-networks market in South Korea is evolving, with increasing market consolidation among key players. Major telecommunications companies are acquiring smaller firms to enhance their technological capabilities and expand their service offerings. This trend is indicative of a strategic shift towards creating comprehensive solutions that integrate small cell technology with existing infrastructure. As competition intensifies, companies are likely to invest more in research and development, fostering innovation within the small cell-networks market. The consolidation trend may also lead to improved pricing strategies and service quality, ultimately benefiting consumers and businesses alike.

Technological Advancements in Network Infrastructure

Technological advancements play a crucial role in shaping the small cell-networks market in South Korea. Innovations in network infrastructure, such as the development of advanced antennas and backhaul solutions, are enhancing the efficiency and performance of small cell deployments. The integration of artificial intelligence and machine learning into network management systems is also streamlining operations, allowing for better resource allocation and maintenance. As a result, the small cell-networks market is poised for growth, with investments in these technologies expected to increase by approximately 15% annually over the next five years. This trend suggests that companies are recognizing the importance of modernizing their network infrastructure to meet the demands of a digital-first economy.