Growing Focus on Sustainability

Sustainability is emerging as a critical driver in the US security paper market. With increasing awareness of environmental issues, consumers and businesses are demanding eco-friendly paper products. Manufacturers are responding by adopting sustainable practices, such as using recycled materials and reducing waste in production processes. The market for sustainable security paper is projected to expand as organizations seek to align their operations with environmental goals. This trend not only addresses consumer preferences but also positions companies favorably in a competitive landscape. As sustainability becomes a priority, the US security paper market is likely to witness a shift towards greener alternatives, potentially reshaping product offerings and production methods.

Expansion of E-Government Services

The expansion of e-government services is influencing the US security paper market by altering the landscape of document issuance and management. As government agencies increasingly adopt digital solutions, the demand for traditional security paper may experience fluctuations. However, the need for secure physical documents remains, particularly for critical applications such as legal documents and identification. The transition to digital services may also drive innovation in security paper, as agencies seek to integrate physical and digital security measures. This dual approach could lead to new opportunities within the US security paper market, as organizations strive to balance the benefits of digitalization with the necessity of secure paper documentation.

Regulatory Compliance and Standards

Regulatory frameworks and compliance standards significantly influence the US security paper market. Government regulations regarding the production and use of security paper are becoming more stringent, necessitating adherence to specific guidelines. For instance, the Federal Reserve has established standards for currency paper, which directly impacts the security paper market. Compliance with these regulations not only ensures the integrity of documents but also fosters consumer trust. As regulatory bodies continue to evolve their standards, manufacturers in the US security paper market must adapt to remain competitive. This dynamic environment may lead to increased investment in research and development to meet compliance requirements while also enhancing product offerings.

Increasing Demand for Secure Documents

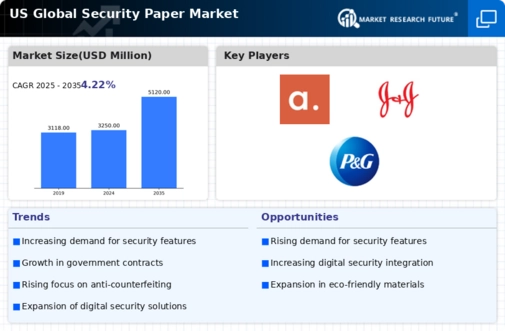

The US security paper market is experiencing a notable increase in demand for secure documents, driven by the rising need for identity verification and fraud prevention. Government agencies, financial institutions, and corporations are increasingly adopting security paper to produce documents such as passports, checks, and certificates. According to recent data, the market for secure documents is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. This growth is largely attributed to heightened concerns over identity theft and counterfeiting, prompting organizations to invest in advanced security features. As a result, the US security paper market is likely to see a surge in innovation and product development to meet these evolving demands.

Technological Innovations in Security Features

Technological advancements are playing a pivotal role in shaping the US security paper market. Innovations such as holograms, watermarks, and color-shifting inks are becoming increasingly prevalent in security paper production. These features not only enhance the security of documents but also improve their aesthetic appeal. The integration of digital technologies, such as QR codes and RFID tags, is also gaining traction, allowing for better tracking and verification of documents. As organizations seek to bolster their security measures, the demand for technologically advanced security paper is expected to rise. This trend indicates a shift towards more sophisticated solutions in the US security paper market, potentially leading to increased competition among manufacturers.