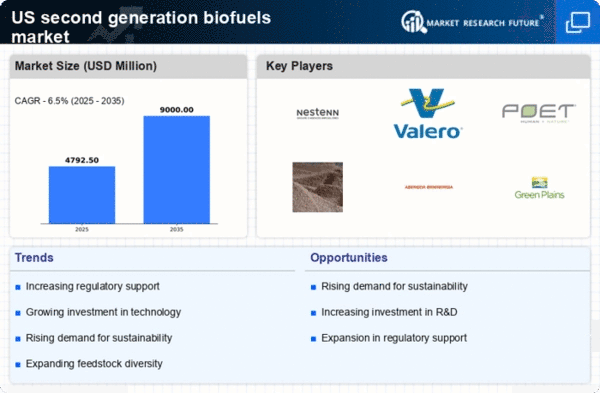

The second generation-bio-fuels market is currently characterized by a dynamic competitive landscape, driven by increasing demand for sustainable energy solutions and stringent regulatory frameworks aimed at reducing carbon emissions. Key players such as Neste (FI), Valero Energy Corporation (US), and POET LLC (US) are strategically positioned to leverage their technological advancements and operational efficiencies. Neste (FI) focuses on innovation in renewable diesel production, while Valero Energy Corporation (US) emphasizes its extensive refining capabilities to integrate biofuels into its existing operations. POET LLC (US) is actively pursuing partnerships to enhance its feedstock supply chain, thereby strengthening its market presence. Collectively, these strategies contribute to a competitive environment that is increasingly focused on sustainability and technological innovation.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency and reduce costs. The market structure appears moderately fragmented, with several key players exerting influence over their respective segments. This fragmentation allows for niche players to emerge, while larger corporations consolidate their market positions through strategic acquisitions and partnerships.

In October Neste (FI) announced a collaboration with a leading agricultural firm to develop advanced feedstock solutions for biofuel production. This partnership is expected to enhance Neste's ability to source sustainable raw materials, thereby improving its production efficiency and reducing its carbon footprint. Such strategic moves indicate a growing trend towards integrating agricultural practices with biofuel production, which may redefine supply chain dynamics in the sector.

In September Valero Energy Corporation (US) unveiled plans to expand its biofuel production capacity by 30% at its existing facilities. This expansion is likely to position Valero as a more formidable player in the biofuels market, allowing it to meet the increasing demand for renewable energy sources. The strategic importance of this move lies in its potential to enhance Valero's competitive edge through economies of scale and improved production capabilities.

In August POET LLC (US) launched a new initiative aimed at increasing the efficiency of its ethanol production processes through digital technologies. This initiative reflects a broader trend towards digital transformation within the industry, suggesting that companies are increasingly investing in technology to optimize operations and reduce costs. The implications of such advancements could lead to significant shifts in production methodologies across the sector.

As of November current competitive trends indicate a strong emphasis on digitalization, sustainability, and the integration of artificial intelligence within operational frameworks. Strategic alliances are becoming increasingly pivotal, as companies seek to enhance their technological capabilities and market reach. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift may redefine the competitive landscape, compelling companies to adopt more sustainable practices and invest in cutting-edge technologies to maintain their market positions.