Growing Commercial Space Sector

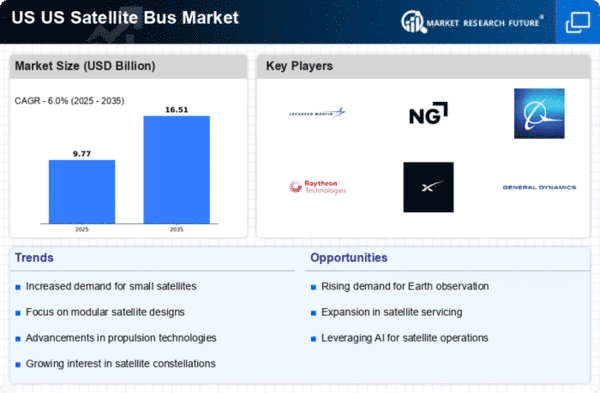

The US Satellite Bus Market is experiencing a notable surge due to the expanding commercial space sector. With private companies increasingly investing in satellite technology, the demand for satellite buses is projected to rise significantly. In 2025, the commercial satellite market in the US was valued at approximately 30 billion USD, and this figure is expected to grow as more businesses seek to leverage satellite capabilities for telecommunications, Earth observation, and data services. This growth is likely to drive innovation in satellite bus design and manufacturing, as companies strive to meet the diverse needs of their clients. Furthermore, the increasing number of satellite launches, which reached over 100 in 2025, indicates a robust market environment that supports the development of advanced satellite buses tailored for various applications.

Government Initiatives and Funding

The US Satellite Bus Market benefits significantly from government initiatives and funding aimed at enhancing national security and technological advancement. The US government has allocated substantial budgets for satellite programs, with the National Aeronautics and Space Administration (NASA) and the Department of Defense (DoD) leading the charge. In 2025, federal funding for satellite-related projects exceeded 15 billion USD, reflecting a commitment to maintaining technological superiority in space. These investments not only bolster the development of satellite buses but also encourage collaboration between government agencies and private sector companies. As a result, the market is likely to see increased innovation and efficiency in satellite bus production, ultimately benefiting both governmental and commercial stakeholders.

International Collaboration and Partnerships

International collaboration and partnerships are becoming increasingly vital in the US Satellite Bus Market. As space exploration and satellite deployment become more globalized, US companies are forming alliances with international entities to share knowledge, resources, and technology. These partnerships can lead to the development of innovative satellite bus designs that incorporate best practices from various countries. In 2025, joint ventures between US firms and foreign companies accounted for approximately 25% of satellite bus projects, indicating a trend towards collaborative efforts in the industry. Such collaborations not only enhance the technological capabilities of satellite buses but also expand market access for US manufacturers, potentially leading to increased sales and a more competitive market landscape.

Technological Advancements in Satellite Design

Technological advancements in satellite design are playing a crucial role in shaping the US Satellite Bus Market. Innovations in materials, miniaturization, and modular designs are enabling the production of more efficient and cost-effective satellite buses. For instance, the introduction of lightweight composite materials has reduced the overall weight of satellites, allowing for more payload capacity and lower launch costs. In 2025, the market for small satellite buses, which utilize these advancements, accounted for nearly 40% of total satellite bus sales in the US. This trend suggests that as technology continues to evolve, the market will likely see a shift towards more sophisticated satellite buses that can accommodate a wider range of missions and applications.

Increased Focus on Earth Observation and Data Analytics

The US Satellite Bus Market is witnessing a heightened focus on Earth observation and data analytics, driven by the growing need for real-time information across various sectors. Industries such as agriculture, disaster management, and urban planning are increasingly relying on satellite data to make informed decisions. In 2025, the demand for Earth observation satellites surged, with a market value estimated at 10 billion USD. This trend is likely to propel the development of specialized satellite buses designed for Earth observation missions, enhancing the capabilities of satellites to capture high-resolution imagery and collect valuable data. As a result, the market may experience a shift towards more advanced satellite bus configurations that cater specifically to these emerging needs.