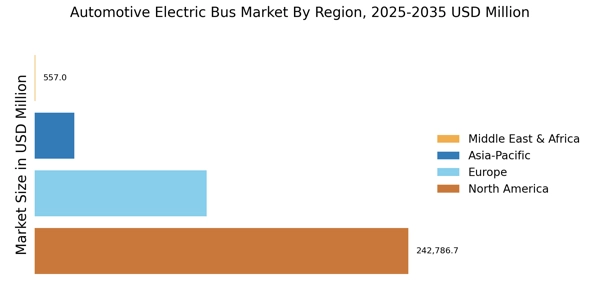

By Region, the study provides market insights into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The Asia Pacific automotive electric bus market accounted for around 85.1% in 2022. Due to the strong demand for electric buses in countries such as China, Japan, South Korea, and India, the market in Asia-Pacific is expected to develop the fastest. Furthermore, China has introduced many electric buses to reduce car emissions.

Chinese firms such as BYD, Yutong, Ankai, and Zhongtong dominate both the Chinese and global electric bus markets. Due to the availability of cheaper parts and components, these players have designed and delivered a wide range of electric bus models at reduced pricing. TMB (Transportes Metropolitanos de Barcelona) placed the first order for 25 new-generation 40-foot BYD electric buses in November 2021, with deliveries due between 2022 and 2024. This directive is part of a plan to phase out polluting diesel buses in Barcelona by 2025.

Figure1: Automotive Electric Bus Market, by Region, 2022 & 2032 (USD million )

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe is the second-largest market, with healthy growth predicted during the forecast period. The strict government rules on automobile emissions are the primary driver of market growth in this region. In this region, many governments have begun programs to make municipal public transit more sustainable by implementing clean and green transportation technologies. In this region, demand for fuel cell buses is also increasing. Over the past decade, European cities have seen an increase in motorization, along with worsening air quality, prompting calls to encourage public transport as a way out of the jam.

Electric buses can play a constructive role in this context, as there are various advantages to switching from traditional diesel buses to electric buses in terms of local pollution, noise, and fuel consumption. The increase in transportation demand and motorization rates is far greater than the increase in infrastructure supply. This has resulted in vehicles using road space beyond the capacity (of certain highways), causing traffic congestion during peak hours.

The increasing concern about the depletion of fossil fuels and rising levels of environmental pollution is driving the expansion of the electric bus market in North America. With expanded governmental measures such as tariff waiver programs for electric bus operators, the US has led the region's electric bus sector. The US is the most promising market in the region, and it is likely to dominate e-bus demand over the projection period. There are already close to 650 electric buses (totaling 2255 zero-emission buses) operating in the US.

Demand exceeds supply, with federal funding making it simple for transit operators to buy new units.

Almost every state in the US has a transit agency that owns or plans to operate modern electric buses. The expansion of the electric bus market in Canada is aided by government programs. Although Canada has electric bus firms like Lion Electric in Quebec and Green Power in Vancouver, the country's adoption rate has been moderate.