Rising Crime Rates

The increasing incidence of crime in various urban areas appears to be a significant driver for the safes vaults market. As property crimes, including burglary and theft, rise, individuals and businesses are more inclined to invest in secure storage solutions. According to recent data, property crime rates in the US have shown a notable uptick, prompting consumers to seek enhanced security measures. This trend indicates a growing awareness of the need for personal and business security, thereby bolstering demand for safes and vaults. The safes vaults market is likely to benefit from this heightened concern, as consumers prioritize safeguarding their valuables against potential threats.

Increased Demand from Businesses

The safes vaults market is experiencing a surge in demand from various business sectors, including retail, banking, and hospitality. Businesses are increasingly recognizing the importance of securing cash, sensitive documents, and valuable assets. The retail sector, in particular, has seen a rise in theft incidents, prompting store owners to invest in robust security solutions. Reports indicate that the commercial segment of the safes vaults market is expected to account for a substantial share, potentially exceeding 40% of total market revenue. This trend underscores the critical need for businesses to protect their assets, driving growth in the safes vaults market.

Regulatory Requirements for Security

Regulatory frameworks surrounding security measures are evolving, influencing the safes vaults market. Various industries, particularly finance and healthcare, are subject to stringent regulations regarding the protection of sensitive information and assets. Compliance with these regulations often necessitates the use of secure storage solutions, including safes and vaults. As businesses strive to meet these legal requirements, the demand for high-quality security products is expected to rise. The safes vaults market is likely to benefit from this trend, as organizations seek to ensure compliance while safeguarding their assets.

Technological Advancements in Security

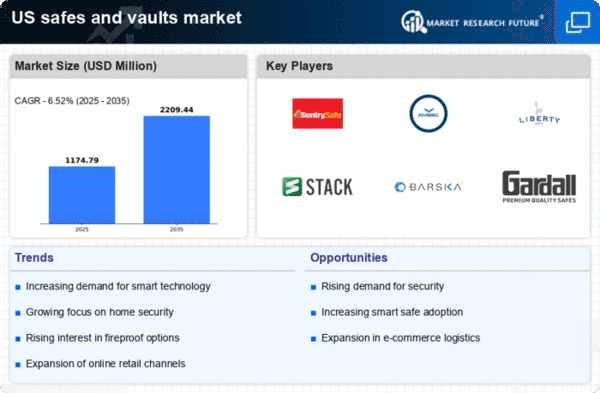

Innovations in security technology are transforming the safes vaults market. The integration of smart technology, such as biometric locks and remote monitoring systems, is becoming increasingly prevalent. These advancements not only enhance security but also appeal to tech-savvy consumers who seek convenience and advanced features. The market for smart safes is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This evolution in technology within the safes vaults market indicates a shift towards more sophisticated security solutions, catering to the demands of modern consumers.

Consumer Awareness of Security Solutions

There is a growing consumer awareness regarding the importance of security solutions, which is positively impacting the safes vaults market. As individuals become more informed about the risks associated with inadequate security, they are more likely to invest in safes and vaults. Educational campaigns and media coverage surrounding security threats have contributed to this heightened awareness. The safes vaults market is likely to see an increase in sales as consumers prioritize the protection of their valuables. This trend suggests that informed consumers are driving demand for reliable and effective security solutions.