Rising Security Concerns

The Safes and Vaults Industry experiences a notable surge in demand driven by increasing security concerns among individuals and businesses. As crime rates fluctuate and the need for asset protection intensifies, consumers are investing in high-quality safes and vaults, including advanced commercial vault systems to safeguard critical assets and sensitive information. This trend is particularly evident in urban areas where theft and burglary rates are higher. The market is projected to reach 5.51 USD Billion in 2024, reflecting a growing awareness of the importance of safeguarding valuables. This heightened focus on security is likely to propel the industry forward, as more consumers seek reliable solutions to protect their assets.

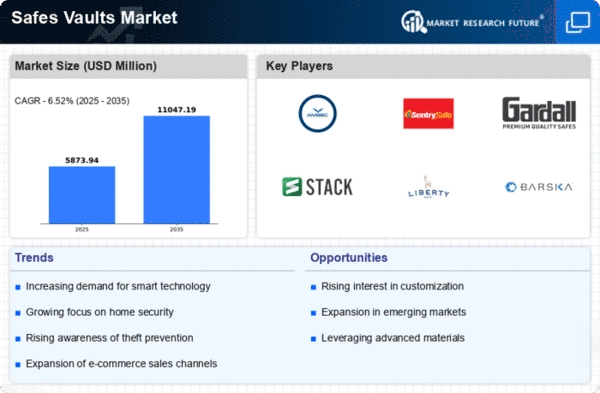

Market Growth Projections

The Safes and Vaults Market is poised for substantial growth, with projections indicating a market size of 5.51 USD Billion in 2024 and an anticipated increase to 11.0 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 6.49% from 2025 to 2035. Such figures reflect the increasing demand for security solutions across various sectors, including residential, commercial, and financial. The market's expansion is likely to be driven by evolving consumer preferences, technological advancements, and heightened security concerns, positioning the industry for a promising future.

Technological Advancements

Technological innovations play a pivotal role in shaping the Safes and Vaults Market. The integration of smart technology into safes, such as biometric locks and remote access features, enhances security and convenience. These advancements cater to a tech-savvy consumer base that both safety valve and ease valve of use. As a result, manufacturers are increasingly incorporating these features into their products, which may lead to a broader market appeal. The anticipated growth of the market to 11.0 USD Billion by 2035 underscores the potential impact of these technological developments on consumer purchasing decisions.

Expansion of E-commerce Platforms

The rise of e-commerce platforms significantly impacts the Global Safes and Vaults Industry by providing consumers with easier access to a wide variety of security products. Online shopping allows customers to compare features, prices, and reviews, facilitating informed purchasing decisions. This trend is particularly advantageous for niche products, such as specialized safes and vaults, which may not be readily available in traditional retail outlets. As e-commerce continues to expand, it is likely to contribute to the overall growth of the market, enabling manufacturers to reach a broader audience and enhance sales.

Increased Awareness of Personal Safety

The Safes and Vaults Industry is influenced by a growing awareness of personal safety among consumers. Individuals are increasingly recognizing the need to protect not only their valuables but also sensitive documents and personal information. This shift in consumer mindset is driving the demand for home safes and personal vaults, as people seek to mitigate risks associated with theft and loss. As the market evolves, manufacturers are responding by offering a diverse range of products tailored to meet these emerging needs, thereby expanding their customer base and enhancing market growth.

Growing Demand from Financial Institutions

Financial institutions are significant contributors to the Safes and Vaults Industry, as they require robust security solutions to protect sensitive information and assets. Banks and credit unions are increasingly investing in advanced vault systems to ensure the safety of cash and confidential documents. This trend is further amplified by regulatory requirements mandating stringent security measures. The steady growth in the financial sector, coupled with the projected CAGR of 6.49% from 2025 to 2035, indicates a sustained demand for high-security vaults and safes, reinforcing the industry's importance in safeguarding financial assets.