Increased Awareness and Advocacy

There appears to be a growing awareness and advocacy surrounding sacroiliitis and related conditions, which may positively impact the treatment market. Patient advocacy groups and healthcare organizations are actively promoting education about sacroiliitis, its symptoms, and available treatment options. This heightened awareness is likely to lead to increased patient engagement and demand for medical consultations. Furthermore, educational campaigns may encourage individuals to seek early intervention, which could result in a larger patient base for the sacroiliitis treatment market. As awareness continues to rise, it is anticipated that more patients will pursue effective treatment solutions, thereby driving market growth.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic imaging and assessment tools are likely to enhance the identification of sacroiliitis, thereby driving the treatment market. Enhanced imaging techniques, such as MRI and CT scans, allow for more accurate detection of sacroiliac joint inflammation. This improved diagnostic capability may lead to increased referrals to specialists and subsequent treatment interventions. The market for diagnostic imaging in the US is projected to grow at a CAGR of around 5.5% through 2026, indicating a robust demand for advanced diagnostic solutions. As healthcare providers become more adept at diagnosing sacroiliitis, the treatment market is expected to expand, with a greater emphasis on tailored therapeutic approaches.

Rising Prevalence of Autoimmune Disorders

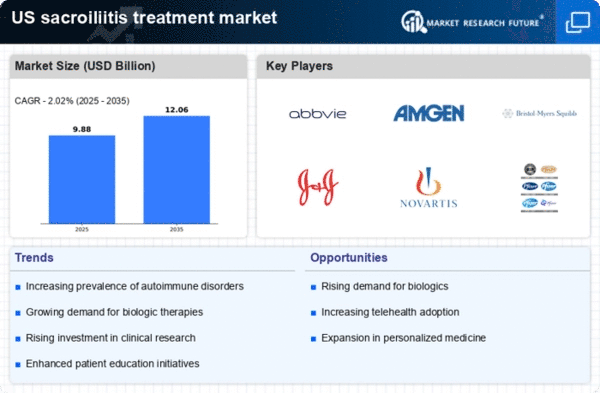

The increasing incidence of autoimmune disorders, particularly ankylosing spondylitis and other related conditions, appears to be a significant driver for the sacroiliitis treatment market. As these disorders often lead to sacroiliitis, the demand for effective treatment options is likely to rise. Recent estimates suggest that autoimmune diseases affect approximately 24 million individuals in the US, with a notable portion experiencing sacroiliitis. This growing patient population necessitates advancements in treatment modalities, including pharmaceuticals and physical therapies, thereby propelling the market forward. Furthermore, the rising awareness of these conditions among healthcare providers and patients may lead to earlier diagnosis and intervention, further stimulating the sacroiliitis treatment market.

Growing Investment in Research and Development

The sacroiliitis treatment market is likely to benefit from increased investment in research and development (R&D) by pharmaceutical companies and academic institutions. This investment is aimed at discovering novel therapeutic agents and treatment protocols that can effectively manage sacroiliitis. In recent years, funding for R&D in the field of rheumatology has seen a notable uptick, with expenditures reaching approximately $5 billion annually in the US. This financial commitment suggests a strong focus on developing innovative treatments, which may include biologics and targeted therapies. As new treatment options emerge, the sacroiliitis treatment market is expected to experience growth driven by enhanced efficacy and safety profiles.

Aging Population and Increased Healthcare Access

The aging population in the US is a critical factor influencing the sacroiliitis treatment market. As individuals age, the likelihood of developing musculoskeletal disorders, including sacroiliitis, increases. The US Census Bureau projects that by 2030, approximately 20% of the population will be 65 years or older, which may lead to a higher prevalence of sacroiliitis. Additionally, improved access to healthcare services, including insurance coverage and availability of specialists, is likely to facilitate timely diagnosis and treatment. This demographic shift, combined with enhanced healthcare access, suggests a growing market for sacroiliitis treatments, as older adults seek effective management options for their conditions.