Rising Prevalence of Sacroiliitis

The increasing incidence of sacroiliitis in the UK is a primary driver for the sacroiliitis treatment market. Recent studies indicate that approximately 1-2% of the population may experience this condition, leading to a growing demand for effective treatment options. As awareness of sacroiliitis rises, healthcare providers are more likely to diagnose and treat this condition, thereby expanding the market. The prevalence of associated conditions, such as ankylosing spondylitis, further contributes to the need for targeted therapies. This trend suggests that the market will continue to grow as more patients seek relief from chronic pain and inflammation, prompting healthcare systems to allocate resources towards innovative treatment solutions.

Advancements in Treatment Modalities

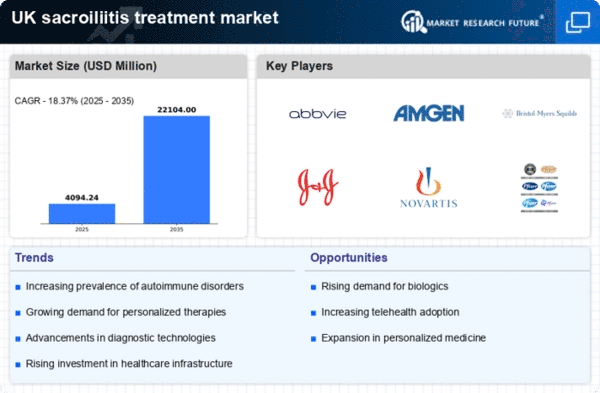

Innovations in treatment modalities are significantly influencing the sacroiliitis treatment market. The introduction of new pharmacological agents, including biologics and targeted therapies, has transformed the therapeutic landscape. For instance, the use of TNF inhibitors has shown promising results in managing symptoms and improving quality of life for patients. Additionally, the development of non-pharmacological interventions, such as physical therapy and lifestyle modifications, complements medical treatments. The market is projected to expand as these advancements become more widely adopted, with an estimated growth rate of around 5-7% annually. This evolution in treatment options is likely to enhance patient outcomes and satisfaction.

Growing Awareness and Education Initiatives

There is a notable increase in awareness and education initiatives surrounding sacroiliitis, which is driving the treatment market. Campaigns aimed at educating both healthcare professionals and the public about the symptoms and management of sacroiliitis are becoming more prevalent. This heightened awareness is likely to lead to earlier diagnosis and treatment, which can significantly improve patient outcomes. Moreover, educational programs may encourage patients to seek medical advice sooner, thereby increasing the demand for treatment options. As awareness continues to grow, the sacroiliitis treatment market may see a corresponding rise in patient numbers seeking effective therapies.

Aging Population and Associated Comorbidities

The aging population in the UK is a critical driver for the sacroiliitis treatment market. As individuals age, the likelihood of developing musculoskeletal disorders, including sacroiliitis, increases. This demographic shift is expected to result in a higher prevalence of the condition, thereby driving demand for effective treatment solutions. Additionally, older adults often present with comorbidities that complicate treatment, necessitating a more comprehensive approach to care. The market may experience growth as healthcare providers adapt to these challenges, offering tailored treatment plans that address both sacroiliitis and its associated conditions. This trend underscores the importance of targeted therapies in managing complex patient needs.

Increased Investment in Healthcare Infrastructure

The UK government has been investing in healthcare infrastructure, which is likely to bolster the sacroiliitis treatment market. Enhanced funding for hospitals and clinics facilitates better access to diagnostic and treatment services for patients suffering from sacroiliitis. This investment is expected to improve the availability of specialized care, including rheumatology services, which are crucial for effective management of the condition. Furthermore, the integration of advanced technologies in healthcare settings may streamline treatment processes, leading to improved patient outcomes. As a result, the market may experience a positive impact from these infrastructural developments, potentially increasing patient engagement and treatment adherence.