Rising Demand for Personalized Medicine

The shift towards personalized medicine is influencing the sacroiliitis market significantly. Tailored treatment plans based on genetic and biomarker profiles are becoming more prevalent, allowing for more effective management of sacroiliitis. This trend is supported by the increasing availability of genetic testing and biomarker identification technologies. The US personalized medicine market was valued at around $350 billion in 2023, indicating a robust growth trajectory. As healthcare providers adopt personalized approaches, the demand for specific therapies targeting sacroiliitis is likely to increase, thereby enhancing market dynamics.

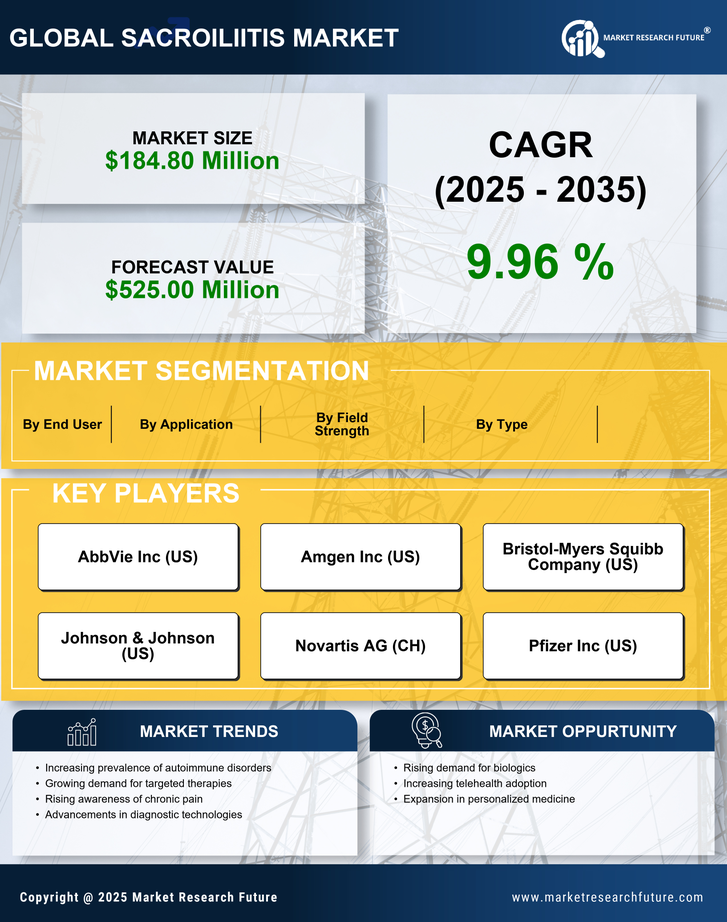

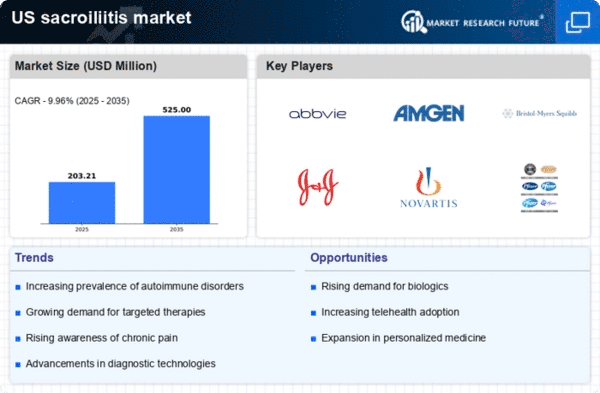

Increasing Prevalence of Autoimmune Disorders

The rising incidence of autoimmune disorders, including ankylosing spondylitis and psoriatic arthritis, is likely to drive the sacroiliitis market. According to recent estimates, autoimmune diseases affect approximately 24 million individuals in the US, with a notable percentage experiencing sacroiliitis as a complication. This growing patient population necessitates enhanced diagnostic and therapeutic options, thereby propelling market growth. The sacroiliitis market is expected to benefit from increased healthcare spending, which reached $4.1 trillion in 2023, as more patients seek treatment for their conditions. As awareness of these disorders expands, healthcare providers are more likely to recognize and diagnose sacroiliitis, further contributing to market expansion.

Technological Innovations in Diagnostic Tools

Advancements in imaging technologies, such as MRI and CT scans, are transforming the diagnostic landscape for sacroiliitis. These innovations enable earlier and more accurate detection of the condition, which is crucial for effective treatment. The sacroiliitis market is poised to grow as healthcare facilities increasingly adopt these advanced diagnostic tools. In 2023, the imaging market in the US was valued at approximately $20 billion, with a significant portion allocated to musculoskeletal imaging. Enhanced diagnostic capabilities not only improve patient outcomes but also drive demand for targeted therapies, thereby fostering growth in the sacroiliitis market.

Enhanced Patient Education and Support Programs

The establishment of patient education and support programs is likely to influence the sacroiliitis market positively. These initiatives aim to empower patients with knowledge about their condition, treatment options, and self-management strategies. As healthcare providers recognize the importance of patient engagement, more resources are being allocated to these programs. In 2023, approximately 60% of healthcare organizations in the US reported implementing patient education initiatives. By fostering a better understanding of sacroiliitis, these programs may lead to earlier diagnosis and treatment, ultimately driving growth in the sacroiliitis market.

Growing Investment in Biologics and Targeted Therapies

Investment in biologics and targeted therapies is a key driver of the sacroiliitis market. These innovative treatments have shown promise in managing inflammation and pain associated with sacroiliitis. The US biologics market was estimated to reach $300 billion in 2023, reflecting a strong interest in developing new therapies. As pharmaceutical companies focus on research and development, the introduction of novel biologics is expected to expand treatment options for patients suffering from sacroiliitis. This influx of new therapies may lead to increased competition and improved patient outcomes, further stimulating market growth.