Growing Threat Landscape

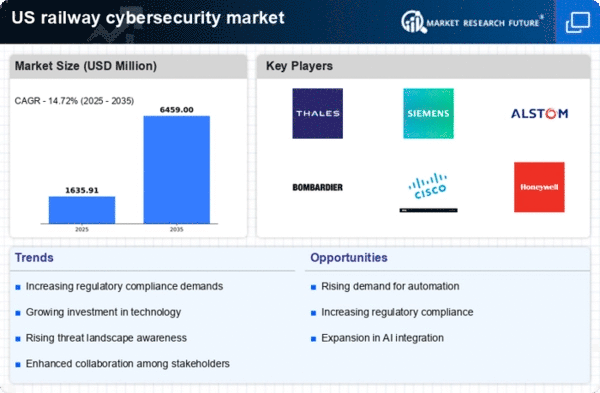

The railway cybersecurity market is experiencing heightened demand due to an increasingly complex threat landscape. Cyberattacks targeting critical infrastructure have surged, with incidents reported to have increased by over 30% in recent years. This alarming trend compels railway operators to invest in advanced cybersecurity measures to protect their systems from potential breaches. The need for robust security solutions is underscored by the reliance on digital technologies in railway operations, which, while enhancing efficiency, also introduces vulnerabilities. As a result, stakeholders in the railway sector are prioritizing cybersecurity investments, leading to a projected market growth rate of approximately 15% annually. This growth reflects the urgent need to safeguard sensitive data and ensure the safety of passengers and freight, thereby driving the railway cybersecurity market forward.

Technological Advancements

Rapid technological advancements are significantly influencing the railway cybersecurity market. The integration of Internet of Things (IoT) devices and artificial intelligence (AI) in railway systems enhances operational efficiency but also raises security concerns. As these technologies evolve, they create new attack vectors that malicious actors may exploit. Consequently, railway operators are compelled to adopt cutting-edge cybersecurity solutions to mitigate risks associated with these innovations. The market is projected to reach a valuation of $5 billion by 2027, driven by the demand for sophisticated security measures that can adapt to emerging threats. This trend indicates a shift towards proactive cybersecurity strategies, where continuous monitoring and real-time threat detection become essential components of railway operations, thereby propelling the railway cybersecurity market.

Increased Regulatory Scrutiny

The railway cybersecurity market is significantly impacted by increased regulatory scrutiny aimed at enhancing the security of critical infrastructure. Regulatory bodies are implementing stringent guidelines and standards that require railway operators to adopt comprehensive cybersecurity frameworks. For instance, the Federal Railroad Administration (FRA) has introduced regulations mandating risk assessments and incident response plans for railway systems. Compliance with these regulations is not only essential for operational continuity but also for avoiding substantial fines, which can reach up to $1 million for non-compliance. This regulatory environment is driving investments in cybersecurity solutions, as companies seek to align with legal requirements while ensuring the safety of their operations. As a result, the railway cybersecurity market is expected to grow as organizations prioritize compliance and risk management.

Public Awareness and Safety Concerns

Public awareness regarding cybersecurity threats has escalated, influencing the railway cybersecurity market. High-profile cyber incidents have raised concerns among passengers and stakeholders about the safety of railway systems. This growing awareness is prompting railway operators to prioritize cybersecurity investments to reassure the public and maintain trust. Surveys indicate that over 70% of passengers express concerns about the security of their personal data while using railway services. In response, companies are increasingly adopting transparent cybersecurity practices and investing in advanced technologies to enhance their security posture. This shift not only addresses public concerns but also positions railway operators as responsible entities committed to safeguarding their customers. Consequently, the railway cybersecurity market is likely to expand as organizations strive to meet public expectations and enhance their security measures.

Investment in Infrastructure Modernization

Investment in infrastructure modernization is a key driver of the railway cybersecurity market. As railway systems undergo upgrades to improve efficiency and service quality, the integration of modern technologies necessitates enhanced cybersecurity measures. The modernization efforts often involve the deployment of smart technologies, which, while beneficial, introduce new vulnerabilities that must be addressed. The U.S. government has allocated over $2 billion for railway infrastructure improvements, emphasizing the need for concurrent investments in cybersecurity. This dual focus on modernization and security is crucial for ensuring the resilience of railway operations against cyber threats. As a result, the railway cybersecurity market is poised for growth, driven by the imperative to secure modernized systems and protect critical infrastructure.