Growing Threat Landscape

The railway cybersecurity market is experiencing heightened demand due to an increasingly complex threat landscape. Cyberattacks targeting critical infrastructure have surged, with the UK railway sector being a prime target. Reports indicate that cyber incidents in transportation systems have risen by over 30% in recent years. This alarming trend compels railway operators to invest in advanced cybersecurity measures to protect sensitive data and ensure operational continuity. The potential financial impact of a successful cyberattack can exceed millions of pounds, making robust cybersecurity solutions essential. As a result, stakeholders in the railway cybersecurity market are prioritizing investments in threat detection, incident response, and risk management strategies to mitigate vulnerabilities and safeguard their systems against evolving cyber threats.

Technological Advancements

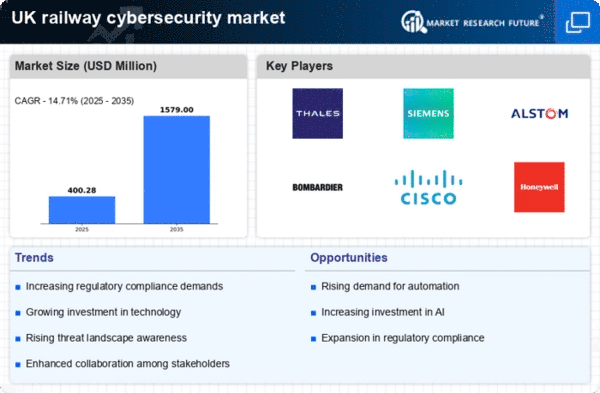

Rapid technological advancements are significantly influencing the railway cybersecurity market. The integration of Internet of Things (IoT) devices and smart technologies in railway operations has created new vulnerabilities that require sophisticated cybersecurity solutions. The market is projected to grow at a CAGR of approximately 12% over the next five years, driven by the need for innovative security measures. Technologies such as artificial intelligence and machine learning are being increasingly adopted to enhance threat detection and response capabilities. These advancements enable railway operators to proactively identify and neutralize potential threats before they escalate. Consequently, the railway cybersecurity market is evolving to incorporate cutting-edge technologies that address the unique challenges posed by modern railway systems.

Increased Regulatory Scrutiny

The railway cybersecurity market is under increasing regulatory scrutiny as governments and regulatory bodies emphasize the importance of cybersecurity in critical infrastructure. In the UK, the Department for Transport has introduced stringent guidelines aimed at enhancing the cybersecurity posture of railway operators. Compliance with these regulations is not only mandatory but also essential for maintaining public trust. Failure to adhere to these standards can result in substantial fines and reputational damage. As a result, railway operators are compelled to invest in comprehensive cybersecurity frameworks to ensure compliance and protect their assets. This regulatory environment is driving growth in the railway cybersecurity market, as organizations seek to align their practices with evolving legal requirements.

Investment in Cybersecurity Training

Investment in cybersecurity training for personnel is becoming a critical driver in the railway cybersecurity market. As cyber threats evolve, the need for skilled professionals who can effectively manage and respond to these threats is paramount. The UK railway sector is increasingly recognizing the importance of training programs that equip employees with the necessary skills to identify and mitigate cyber risks. Reports suggest that organizations investing in cybersecurity training see a reduction in security incidents by up to 50%. This focus on human capital development is essential for creating a resilient cybersecurity culture within railway organizations. Consequently, the railway cybersecurity market is likely to witness growth as companies prioritize training initiatives to enhance their workforce's capabilities.

Public Awareness and Safety Concerns

Public awareness regarding cybersecurity threats in the railway sector is on the rise, leading to increased pressure on operators to enhance their security measures. High-profile cyber incidents have raised concerns about passenger safety and data privacy, prompting calls for more robust cybersecurity protocols. The railway cybersecurity market is responding to these concerns by developing solutions that prioritize passenger safety and data integrity. Surveys indicate that over 70% of passengers express concern about the security of their personal information when using railway services. This growing awareness is likely to drive investments in cybersecurity technologies and practices, as operators strive to reassure the public and maintain confidence in the safety of railway travel.