Growing Geriatric Population

The increasing geriatric population in the US is a significant factor influencing the radial artery-compression-devices market. As individuals age, the prevalence of cardiovascular diseases tends to rise, leading to a higher demand for interventions that utilize radial access. The aging demographic is expected to drive the volume of procedures requiring effective hemostasis solutions. By 2030, it is projected that nearly 20% of the US population will be over 65 years old, further amplifying the need for reliable radial artery-compression devices. This demographic shift suggests a sustained growth trajectory for the market as healthcare providers adapt to the needs of an older population.

Supportive Reimbursement Policies

The presence of favorable reimbursement policies in the US is a crucial driver for the radial artery-compression-devices market. Insurance providers are increasingly covering the costs associated with advanced compression devices, making them more accessible to healthcare facilities. This financial support encourages hospitals to adopt these devices, as they can improve procedural outcomes while minimizing costs related to complications. As reimbursement frameworks evolve to support innovative medical technologies, the radial artery-compression-devices market is likely to experience growth. The alignment of reimbursement policies with the adoption of these devices may lead to increased utilization in various clinical settings.

Rising Awareness of Patient Safety

There is a growing emphasis on patient safety within the healthcare sector, which is driving the radial artery-compression-devices market. Healthcare providers are increasingly prioritizing the use of devices that minimize complications associated with arterial access. This heightened awareness is leading to the adoption of advanced compression devices that ensure effective hemostasis and reduce the risk of hematomas and other complications. As hospitals and clinics implement stricter safety protocols, the demand for reliable radial artery-compression devices is expected to rise. The market could see a notable increase in sales as healthcare facilities invest in technologies that align with these safety initiatives.

Increasing Cardiovascular Procedures

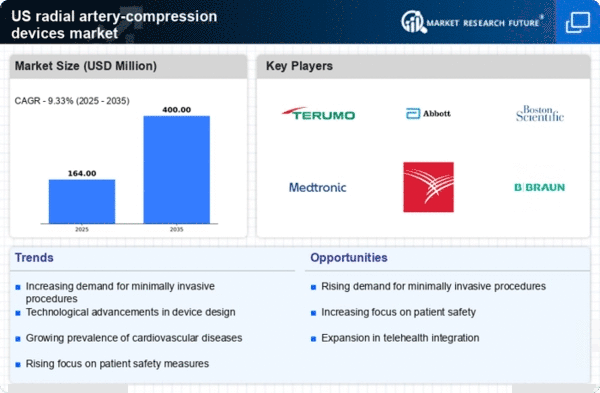

The rising incidence of cardiovascular diseases in the US is a primary driver for the radial artery-compression-devices market. As healthcare providers increasingly adopt minimally invasive procedures, the demand for effective compression devices has surged. In 2025, it is estimated that over 1 million coronary interventions will be performed, necessitating reliable solutions for hemostasis. This trend indicates a growing reliance on radial artery access, which in turn propels the need for advanced compression devices. The radial artery-compression-devices market is expected to witness a compound annual growth rate (CAGR) of approximately 8% over the next few years, reflecting the increasing volume of these procedures and the corresponding demand for innovative solutions.

Technological Innovations in Device Design

Innovations in the design and functionality of radial artery-compression-devices are significantly influencing the market. Manufacturers are focusing on developing devices that enhance user experience and improve patient outcomes. Features such as adjustable pressure settings, ergonomic designs, and integrated monitoring systems are becoming more prevalent. These advancements not only facilitate easier application but also ensure effective hemostasis, thereby reducing complications. The radial artery-compression-devices market is projected to grow as these innovations attract healthcare providers seeking to enhance procedural efficiency and patient safety. The introduction of smart technologies may further revolutionize the market, potentially increasing device adoption rates.