Rising Incidence of Rabies Cases

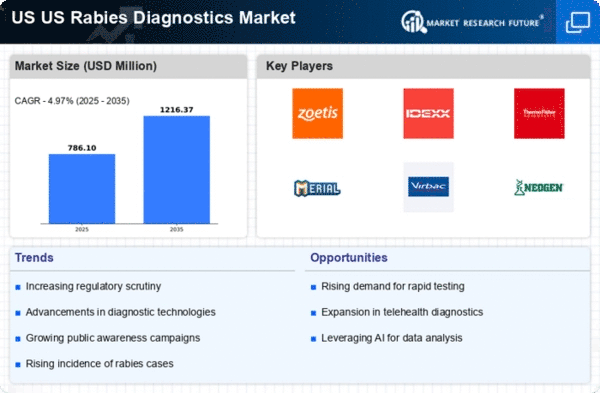

The US Rabies Diagnostics Market is experiencing growth due to the rising incidence of rabies cases in certain regions. According to the Centers for Disease Control and Prevention (CDC), rabies remains a public health concern, particularly in areas with high populations of wildlife such as bats and raccoons. The increase in reported rabies cases necessitates the development and implementation of effective diagnostic tools. This trend is likely to drive demand for advanced rabies diagnostic solutions, as healthcare providers seek to enhance their capabilities in identifying and managing rabies exposure. The heightened awareness of rabies risks among the public and healthcare professionals further contributes to the market's expansion, as timely diagnosis is crucial for effective post-exposure prophylaxis.

Increased Awareness and Education

The growing awareness of rabies and its implications for public health is a significant driver of the US Rabies Diagnostics Market. Educational campaigns conducted by health organizations and veterinary associations are informing the public about the risks associated with rabies exposure and the importance of timely diagnosis. This heightened awareness is leading to increased demand for rabies diagnostic services, as individuals seek to understand their risk and the necessary precautions. Furthermore, as pet ownership rises, the need for rabies vaccinations and subsequent diagnostics becomes more pronounced. This trend suggests that the market will continue to expand as more individuals recognize the importance of rabies diagnostics in safeguarding both human and animal health.

Government Initiatives and Funding

Government initiatives aimed at rabies prevention and control are playing a pivotal role in shaping the US Rabies Diagnostics Market. Federal and state agencies are increasingly allocating funds for rabies surveillance and research, which directly impacts the demand for diagnostic services. For example, the CDC has implemented programs to monitor rabies in wildlife populations, thereby necessitating the use of reliable diagnostic methods. Additionally, public health campaigns aimed at educating communities about rabies prevention further drive the need for effective diagnostics. This proactive approach by government entities not only enhances public health safety but also stimulates market growth by fostering innovation in rabies diagnostic technologies.

Emerging Veterinary Diagnostics Market

The US Rabies Diagnostics Market is also being influenced by the growth of the veterinary diagnostics sector. As pet ownership increases, there is a corresponding rise in the demand for veterinary services, including rabies diagnostics. Veterinarians are increasingly utilizing advanced diagnostic tools to ensure the health and safety of pets, which in turn drives the need for reliable rabies testing. The integration of diagnostic services within veterinary practices not only enhances animal health management but also contributes to public health efforts by preventing rabies transmission from animals to humans. This synergy between human and veterinary diagnostics is likely to foster collaboration and innovation within the market, ultimately benefiting both sectors.

Technological Innovations in Diagnostic Tools

Technological advancements are significantly influencing the US Rabies Diagnostics Market. Innovations such as rapid diagnostic tests and molecular techniques are enhancing the accuracy and speed of rabies detection. For instance, the introduction of real-time PCR assays has improved the sensitivity of rabies virus detection in clinical samples. These advancements not only facilitate timely diagnosis but also reduce the burden on healthcare systems by enabling quicker decision-making regarding treatment. As diagnostic technologies continue to evolve, the market is likely to witness increased adoption of these innovative tools, which could lead to improved patient outcomes and a more efficient response to rabies outbreaks.