Growing Awareness of Blood Safety

There is a growing awareness of the importance of blood safety among healthcare providers and patients, which is driving the Global Blood Transfusion Diagnostics Market Industry. Educational campaigns and initiatives aimed at promoting safe blood transfusion practices are becoming more prevalent. This heightened awareness leads to increased demand for reliable diagnostic tools that can ensure the safety of blood products. As healthcare systems prioritize patient safety, the market for blood transfusion diagnostics is expected to benefit, with projections indicating a market value of 6.5 USD Billion by 2035, underscoring the long-term potential of this driver.

Regulatory Support and Guidelines

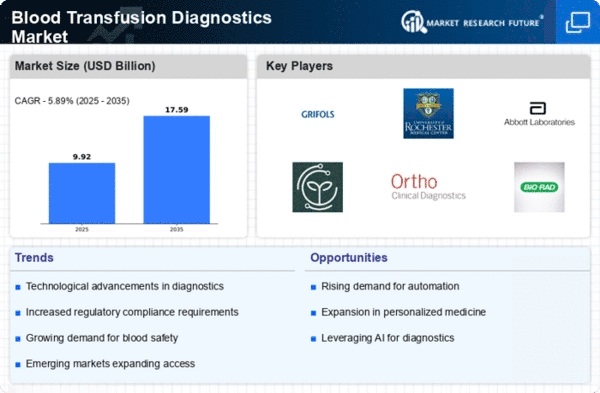

Supportive regulatory frameworks and guidelines established by health authorities are fostering growth in the Global Blood Transfusion Diagnostics Market Industry. Agencies such as the Food and Drug Administration and the European Medicines Agency are continuously updating regulations to ensure the safety and efficacy of blood transfusion diagnostics. These regulations encourage innovation and compliance among manufacturers, leading to the introduction of new diagnostic products. As a result, the market is likely to expand, with a projected compound annual growth rate of 3.42% from 2025 to 2035, reflecting the positive impact of regulatory support on industry growth.

Rising Demand for Blood Components

The increasing demand for various blood components, such as red blood cells, platelets, and plasma, is significantly influencing the Global Blood Transfusion Diagnostics Market Industry. Factors such as an aging population and the rise in surgical procedures contribute to this demand. For instance, the American Red Cross reports that blood donations are essential to meet the needs of patients undergoing surgeries or treatments for chronic illnesses. This growing requirement for blood components necessitates efficient diagnostic tools to ensure compatibility and safety, thereby propelling market growth in the coming years.

Increasing Prevalence of Blood Disorders

The rising incidence of blood disorders, such as hemophilia, thalassemia, and sickle cell anemia, is a pivotal driver for the Global Blood Transfusion Diagnostics Market Industry. As these conditions necessitate frequent blood transfusions, the demand for accurate and efficient diagnostic tools is expected to surge. For instance, the World Health Organization reports that millions of people worldwide suffer from these disorders, leading to an increased need for reliable transfusion diagnostics. This trend is anticipated to contribute significantly to the market's growth, with projections indicating a market value of 4.49 USD Billion in 2024.

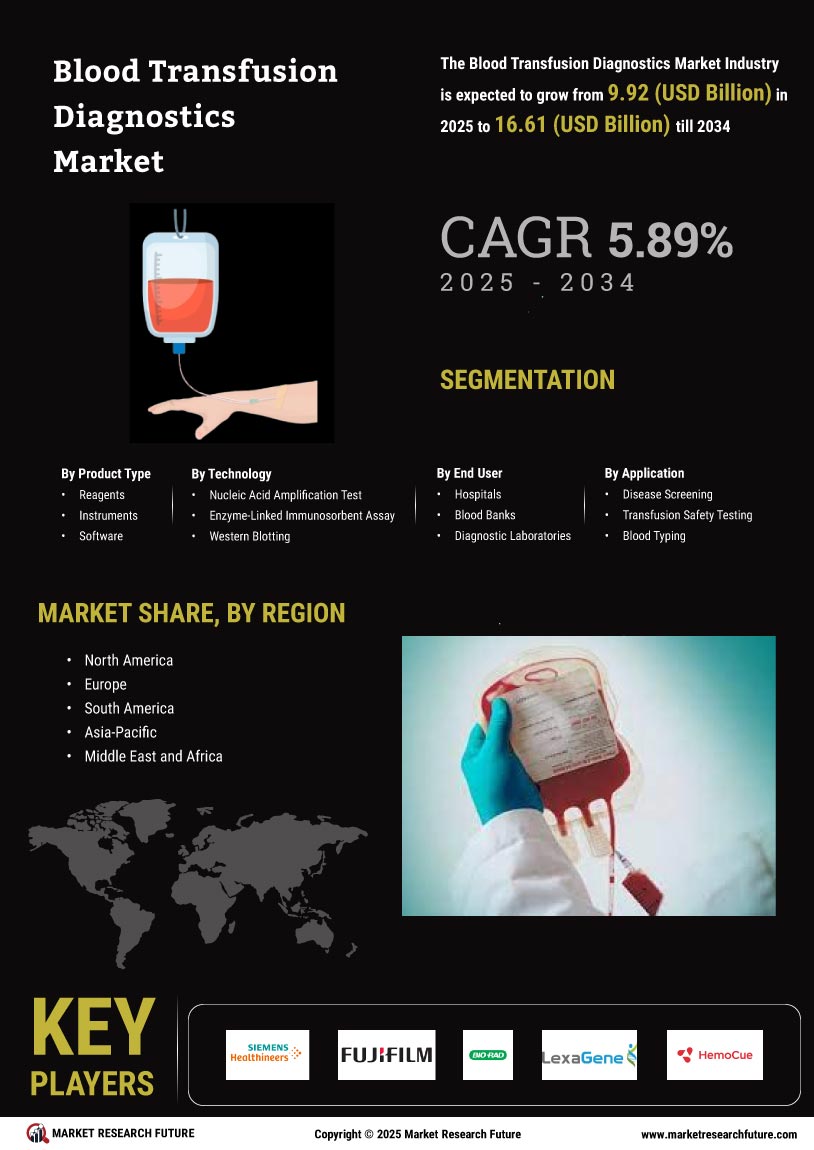

Technological Advancements in Diagnostic Tools

Innovations in blood transfusion diagnostics, including the development of automated systems and advanced molecular techniques, are transforming the Global Blood Transfusion Diagnostics Market Industry. These advancements enhance the accuracy and speed of blood testing, thereby improving patient outcomes. For example, the introduction of next-generation sequencing and multiplex assays allows for the simultaneous detection of multiple pathogens in blood samples. Such technological progress not only streamlines the diagnostic process but also reduces the risk of transfusion-related infections, which is crucial for maintaining patient safety and trust in blood transfusion practices.