Growth of Packaging Industry

The packaging industry is a significant driver of the printing machinery market, particularly in the United States. With the increasing emphasis on product presentation and branding, companies are investing heavily in high-quality packaging solutions. The demand for sustainable packaging options is also on the rise, prompting manufacturers to develop printing machinery that can accommodate eco-friendly materials. In 2025, the packaging sector is expected to account for nearly 30% of the total revenue generated by the printing machinery market. This growth is fueled by the expansion of e-commerce and retail sectors, which require innovative packaging solutions to enhance consumer experience. As a result, printing machinery manufacturers are focusing on developing versatile machines that can handle various substrates and printing techniques, thereby catering to the diverse needs of the packaging industry.

Expansion of Digital Printing

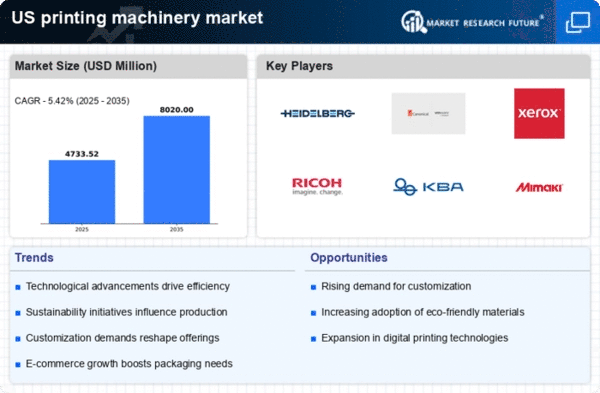

The shift towards digital printing is a pivotal driver in the printing machinery market. Digital printing offers numerous advantages, including shorter turnaround times, lower setup costs, and the ability to produce small print runs economically. This technology is particularly appealing to businesses looking to reduce waste and enhance flexibility in their printing operations. In 2025, digital printing is projected to represent over 50% of the total printing volume in the United States, reflecting a significant shift in consumer preferences. As a result, manufacturers are increasingly focusing on developing high-speed digital printing machines that can deliver superior quality while maintaining cost-effectiveness. This expansion of digital printing capabilities is likely to reshape the competitive dynamics of the printing machinery market, as companies strive to meet the growing demand for efficient and versatile printing solutions.

Rising Demand for Customization

The printing machinery market is experiencing a notable surge in demand for customized printing solutions. Businesses across various sectors are increasingly seeking tailored products to meet specific consumer preferences. This trend is particularly evident in the packaging and promotional materials sectors, where unique designs and personalized content are essential for brand differentiation. As a result, manufacturers are investing in advanced printing technologies that enable rapid customization without compromising quality. The market for digital printing machinery, which allows for such flexibility, is projected to grow at a CAGR of approximately 6.5% over the next five years. This shift towards customization is reshaping the competitive landscape of the printing machinery market, compelling companies to innovate and adapt their offerings to meet evolving customer needs.

Increased Focus on Sustainability

Sustainability is becoming a critical consideration in the printing machinery market, as companies seek to minimize their environmental impact. The demand for eco-friendly printing solutions is driving innovation in machinery design and materials used in the printing process. Manufacturers are increasingly developing machines that utilize water-based inks, recyclable substrates, and energy-efficient technologies. In 2025, it is anticipated that around 25% of new printing machinery will be designed with sustainability in mind. This shift not only aligns with consumer preferences for environmentally responsible products but also helps companies comply with stringent regulations regarding waste and emissions. As sustainability becomes a core value for businesses, the printing machinery market is likely to evolve, with manufacturers prioritizing green technologies and practices in their operations.

Technological Integration in Manufacturing

The integration of advanced technologies into manufacturing processes is significantly influencing the printing machinery market. Automation, artificial intelligence, and the Internet of Things (IoT) are becoming increasingly prevalent in printing operations, enhancing efficiency and reducing operational costs. These technologies enable real-time monitoring and predictive maintenance, which can lead to improved productivity and reduced downtime. In 2025, it is estimated that approximately 40% of printing machinery will incorporate some form of automation or smart technology. This trend not only streamlines production but also allows for greater precision and quality control in printing processes. As manufacturers adopt these innovations, the printing machinery market is likely to witness a transformation in operational capabilities, positioning companies to better meet the demands of a rapidly evolving marketplace.