Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a major driver of the pharmaceutical packaging market. As the biopharmaceutical sector expands, the need for specialized packaging solutions that can maintain the stability and efficacy of these sensitive products becomes critical. The market for biopharmaceuticals was anticipated to grow at a CAGR of around 8% over the next five years, which would consequently boost the demand for innovative packaging solutions. This trend indicates that the pharmaceutical packaging market must adapt to accommodate the unique requirements of biopharmaceuticals, thereby creating new opportunities for growth.

Sustainability Initiatives in Packaging

Sustainability initiatives are becoming a crucial driver in the pharmaceutical packaging market. As environmental concerns grow, companies are increasingly adopting eco-friendly packaging materials and practices. This shift is not only driven by regulatory pressures but also by consumer demand for sustainable products. The market for sustainable packaging solutions is projected to grow by 7% annually, reflecting a broader trend towards environmental responsibility. By investing in sustainable packaging, companies can enhance their brand image and appeal to environmentally conscious consumers, thereby positively influencing the pharmaceutical packaging market.

Technological Advancements in Packaging

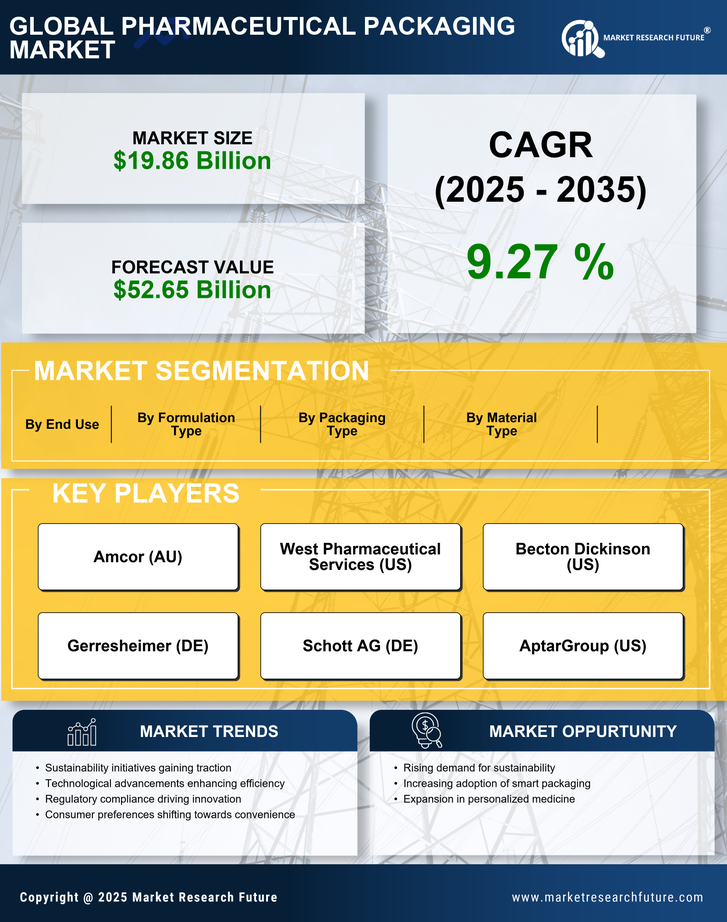

Technological advancements play a pivotal role in shaping the pharmaceutical packaging market. Innovations such as advanced barrier materials, tamper-evident features, and child-resistant packaging are becoming increasingly prevalent. These technologies not only enhance product safety but also improve shelf life and reduce waste. The market is expected to reach a valuation of $50 billion by 2027, with a significant portion attributed to these advancements. As companies strive to differentiate their products, the integration of technology into packaging solutions is likely to remain a key driver in the pharmaceutical packaging market.

Regulatory Compliance and Safety Standards

The pharmaceutical packaging market is heavily influenced by stringent regulatory compliance and safety standards imposed by authorities such as the FDA. These regulations ensure that packaging materials are safe, effective, and suitable for pharmaceutical products. As a result, manufacturers are compelled to invest in high-quality packaging solutions that meet these requirements. The market was projected to grow at a CAGR of approximately 6.5% from 2025 to 2030, driven by the increasing need for compliance with evolving regulations. This focus on safety not only enhances consumer trust but also reduces the risk of product recalls, thereby positively impacting the pharmaceutical packaging market.

Consumer Awareness and Preference for Quality

Consumer awareness regarding the quality and safety of pharmaceutical products is on the rise, significantly impacting the pharmaceutical packaging market. Patients are increasingly seeking assurance that the medications they consume are packaged securely and safely. This shift in consumer preference is prompting manufacturers to prioritize high-quality packaging solutions that not only protect the product but also convey information effectively. As a result, the market is likely to see a surge in demand for packaging that emphasizes quality and safety, potentially leading to a market growth rate of 5% annually over the next few years.