North America : Market Leader in Innovation

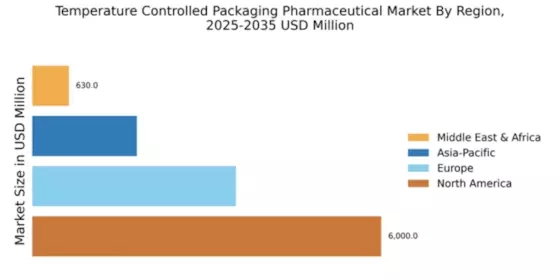

North America is poised to maintain its leadership in the Temperature Controlled Packaging Pharmaceutical Market, holding a market share of $6000.0M as of 2024. The region's growth is driven by increasing demand for biopharmaceuticals and stringent regulatory requirements for temperature-sensitive products. The rise in e-commerce and global trade further fuels the need for efficient cold chain logistics, ensuring product integrity during transit. The United States stands out as a key player, with major companies like Thermo Fisher Scientific and CSafe The Temperature Controlled Packaging Pharmaceutical. The competitive landscape is characterized by innovation in packaging solutions and a focus on sustainability. As regulations tighten, companies are investing in advanced technologies to enhance tracking and monitoring capabilities, ensuring compliance and safety in the distribution of pharmaceuticals.

Europe : Emerging Regulatory Frameworks

Europe's Temperature Controlled Packaging Pharmaceutical Market is projected to grow significantly, with a market size of $3500.0M. The region's growth is largely driven by stringent regulations and the increasing demand for temperature-sensitive medications. The European Medicines Agency (EMA) has implemented guidelines that necessitate robust cold chain solutions, thereby enhancing market dynamics and compliance requirements across member states. Leading countries such as Germany, France, and the UK are at the forefront of this market, with key players like DHL Supply Chain and Sofrigam actively participating. The competitive landscape is marked by collaborations and partnerships aimed at improving supply chain efficiency. As the market evolves, companies are focusing on innovative packaging technologies to meet regulatory standards and consumer expectations, ensuring the safe delivery of pharmaceuticals.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing rapid growth in the Temperature Controlled Packaging Pharmaceutical Market, with a market size of $1800.0M. This growth is driven by increasing healthcare expenditures, rising awareness of biopharmaceuticals, and the expansion of e-commerce. Governments are also investing in infrastructure improvements to support cold chain logistics, which is essential for maintaining product quality and safety during transportation. Countries like China and India are leading the charge, with a growing number of pharmaceutical companies entering the market. The competitive landscape is becoming increasingly dynamic, with local and international players vying for market share. Companies such as Pelican BioThermal and Cold Chain Technologies are focusing on innovative solutions to cater to the unique demands of this diverse region, ensuring compliance with local regulations and standards.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region presents significant growth opportunities in the Temperature Controlled Packaging Pharmaceutical Market, with a market size of $630.0M. The demand for temperature-sensitive pharmaceuticals is rising due to increasing healthcare investments and the need for efficient logistics solutions. Regulatory bodies are beginning to establish guidelines to ensure the safe transport of these products, which is expected to further stimulate market growth. Countries like South Africa and the UAE are emerging as key players in this market, with a focus on enhancing cold chain infrastructure. The competitive landscape is characterized by a mix of local and international companies, including Envirotainer and Cryopak, striving to meet the growing demand. As the market matures, investments in technology and innovation will be crucial for ensuring compliance and improving service delivery in the region.