Integration with IoT Devices

The integration of palm recognition technology with Internet of Things (IoT) devices is emerging as a significant driver for the palm recognition market. As smart devices proliferate, the need for seamless and secure authentication methods becomes increasingly critical. The palm recognition market is likely to see substantial growth as manufacturers incorporate biometric solutions into IoT ecosystems, enhancing user experience and security. This integration not only streamlines access control but also provides a more personalized interaction with devices. The potential for the palm recognition market to expand in this domain is underscored by the projected increase in IoT device shipments, which are expected to reach over 30 billion units by 2025, further solidifying the relevance of biometric authentication.

Growing Adoption in Healthcare

The healthcare sector is rapidly adopting palm recognition technology, which serves as a key driver for the palm recognition market. With the increasing need for secure patient identification and data protection, healthcare providers are turning to biometric solutions to streamline operations and enhance security. The palm recognition market is witnessing a shift as hospitals and clinics implement these systems to reduce errors in patient identification and ensure compliance with regulations. The market is anticipated to grow significantly, with estimates suggesting a valuation of over $1 billion by 2026 in the healthcare segment alone. This trend reflects a broader movement towards digitization and improved patient safety, positioning palm recognition as a vital component in modern healthcare.

Consumer Awareness and Acceptance

Consumer awareness regarding biometric technologies is on the rise, which serves as a significant driver for the palm recognition market. As individuals become more informed about the benefits of biometric authentication, including convenience and security, the acceptance of palm recognition systems is likely to increase. The palm recognition market is poised to capitalize on this growing consumer interest, particularly in retail and personal devices. Surveys indicate that over 60% of consumers express a preference for biometric solutions over traditional passwords, suggesting a shift in consumer behavior. This trend may lead to a broader adoption of palm recognition technology, as businesses respond to consumer demand for more secure and user-friendly authentication methods.

Regulatory Compliance and Standards

Regulatory compliance is becoming a crucial factor influencing the palm recognition market. As industries face increasing scrutiny regarding data protection and privacy, organizations are compelled to adopt biometric solutions that meet stringent regulatory standards. The palm recognition market is likely to benefit from this trend, as businesses seek to align their security measures with compliance requirements. This is particularly relevant in sectors such as finance and healthcare, where regulations mandate robust identity verification processes. The market is expected to expand as companies invest in technologies that not only enhance security but also ensure adherence to legal frameworks, potentially leading to a market growth rate of around 15% in the coming years.

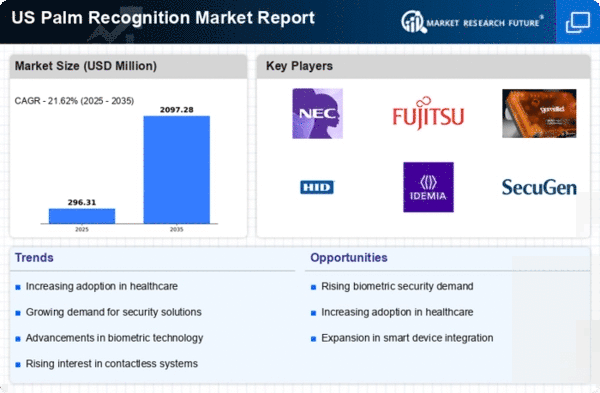

Increased Focus on Biometric Security

The palm recognition market is experiencing a notable surge due to the heightened emphasis on biometric security solutions across various sectors. Organizations are increasingly adopting advanced biometric systems to enhance security protocols, particularly in sensitive environments such as financial institutions and government facilities. The market is projected to grow at a CAGR of approximately 20% over the next five years, driven by the need for robust identity verification methods. This trend indicates a shift towards more secure and efficient authentication processes, as traditional methods are often deemed inadequate. The palm recognition market is thus positioned to benefit from this growing demand for secure biometric solutions, as businesses seek to mitigate risks associated with unauthorized access and identity fraud.