Rising Awareness of Biometric Privacy

As privacy concerns continue to rise among consumers in France, the palm recognition market is witnessing a shift towards solutions that prioritize data protection. The palm recognition market is adapting to these concerns by implementing robust data encryption and storage protocols. This shift is likely to enhance consumer trust, which is essential for the widespread adoption of biometric technologies. In 2025, it is estimated that 60% of consumers will prefer biometric authentication methods that ensure their data privacy. Consequently, companies that prioritize privacy in their palm recognition systems may gain a competitive edge in the market.

Growing Demand for Secure Transactions

The palm recognition market in France is experiencing a notable surge in demand for secure transaction methods. As financial institutions and retailers increasingly prioritize customer security, biometric solutions like palm recognition are becoming essential. In 2025, the market is projected to grow by approximately 15%, driven by the need for enhanced security measures against fraud. This trend is particularly evident in sectors such as banking and e-commerce, where the integration of palm recognition technology can significantly reduce unauthorized access. The palm recognition market is thus positioned to benefit from this heightened focus on security, as businesses seek to implement advanced authentication methods to protect sensitive customer data.

Expansion of E-commerce and Digital Services

The rapid expansion of e-commerce and digital services in France is driving the palm recognition market forward. As online transactions become increasingly prevalent, the need for secure and efficient authentication methods is paramount. The palm recognition market is poised to capitalize on this trend, with projections indicating a growth rate of 18% by 2025. Retailers and service providers are likely to adopt palm recognition technology to enhance user experience while ensuring security. This shift towards biometric solutions in the digital realm reflects a broader trend of integrating advanced technologies to meet consumer demands.

Increased Investment in Smart City Initiatives

The push for smart city initiatives in France is significantly impacting the palm recognition market. As urban areas seek to enhance security and streamline services, the integration of biometric technologies is becoming a focal point. The palm recognition market is likely to benefit from government investments aimed at improving public safety and efficiency in urban management. By 2025, the market is projected to grow by 20% as municipalities adopt palm recognition systems for access control in public buildings and transportation hubs. This trend indicates a broader acceptance of biometric solutions in public infrastructure.

Technological Advancements in Biometric Systems

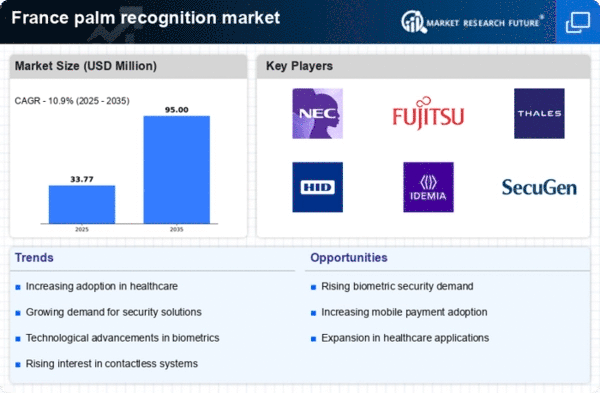

Technological advancements are playing a crucial role in shaping the palm recognition market in France. Innovations in sensor technology and machine learning algorithms are enhancing the accuracy and efficiency of palm recognition systems. As these technologies evolve, the cost of implementation is expected to decrease, making it more accessible for various industries. In 2025, the market is anticipated to reach a valuation of €200 million, reflecting a growing acceptance of biometric solutions. The palm recognition market is likely to see increased investment in research and development, fostering a competitive landscape that encourages the adoption of cutting-edge biometric technologies.