Growth of the E-commerce Sector

The rapid growth of the e-commerce sector is significantly impacting the packaging assembly-equipment market, as businesses adapt to the increasing demand for efficient packaging solutions. With online shopping becoming a dominant retail channel, companies are investing in equipment that can handle diverse packaging needs, from small parcels to bulk shipments. This shift is expected to drive a growth rate of around 9% in the packaging assembly-equipment market, as firms seek to enhance their packaging capabilities to meet consumer expectations for speed and convenience. The need for efficient, scalable solutions is likely to continue shaping the market landscape in the coming years.

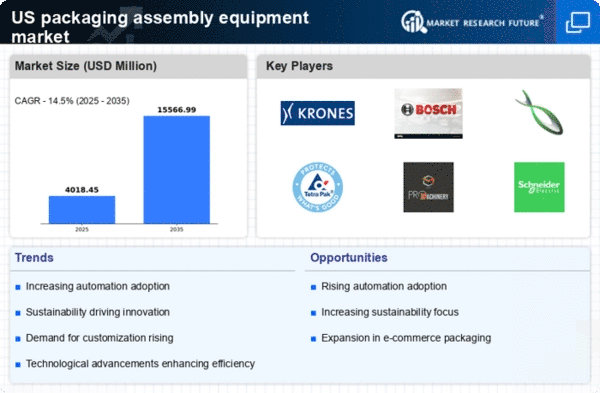

Rising Demand for Customization

Customization is becoming a pivotal factor in the packaging assembly-equipment market, as consumers increasingly seek personalized products. This trend is particularly evident in sectors such as food and beverage, where unique packaging can enhance brand identity and consumer appeal. Companies are responding by investing in flexible packaging solutions that can accommodate various sizes and designs. The market for customized packaging solutions is expected to expand significantly, with estimates suggesting a growth rate of around 10% over the next few years. This demand for tailored solutions is compelling manufacturers to adapt their assembly equipment, thereby driving innovation and investment in the packaging assembly-equipment market.

Technological Advancements in Machinery

The packaging assembly-equipment market is experiencing a surge in technological advancements, particularly in machinery that enhances efficiency and productivity. Innovations such as smart sensors and IoT connectivity are becoming increasingly prevalent, allowing for real-time monitoring and data analytics. This integration of technology not only streamlines operations but also reduces downtime, which is crucial for manufacturers aiming to meet rising consumer demands. In 2025, the market is projected to grow by approximately 8% annually, driven by these advancements. As companies invest in state-of-the-art equipment, they are likely to see improved operational efficiency and reduced labor costs, making technological innovation a key driver in the packaging assembly-equipment market.

Increased Focus on Supply Chain Efficiency

The packaging assembly-equipment market is witnessing a heightened focus on supply chain efficiency, as businesses strive to optimize their operations. This emphasis is driven by the need to reduce costs and improve delivery times in a competitive landscape. Companies are increasingly adopting automated systems that enhance the speed and accuracy of packaging processes. According to recent data, organizations that implement advanced packaging solutions can achieve up to a 20% reduction in operational costs. This trend towards efficiency is likely to propel investments in new assembly equipment, as firms seek to streamline their supply chains and enhance overall productivity in the packaging assembly-equipment market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent in the packaging assembly-equipment market, compelling manufacturers to invest in equipment that meets these requirements. As safety regulations evolve, companies must ensure that their machinery adheres to the latest guidelines to avoid penalties and maintain operational integrity. This focus on compliance is driving innovation, as manufacturers develop equipment that not only meets safety standards but also enhances productivity. The market is expected to see a growth of approximately 7% as companies prioritize compliance, thereby influencing their purchasing decisions in the packaging assembly-equipment market.