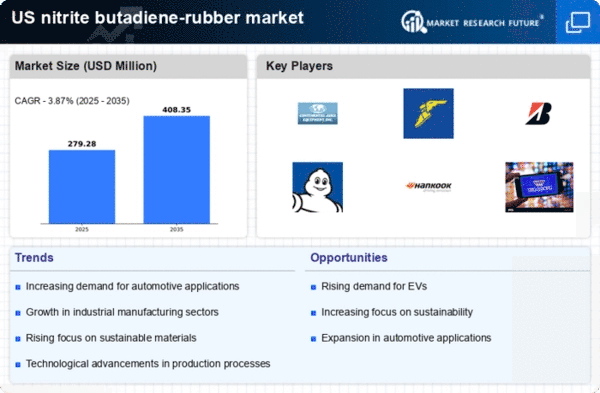

The nitrite butadiene-rubber market exhibits a competitive landscape characterized by a blend of innovation, strategic partnerships, and regional expansion. Key players such as Goodyear Tire & Rubber Company (US), Continental AG (DE), and Michelin (FR) are actively shaping the market dynamics. Goodyear, for instance, emphasizes innovation in product development, focusing on sustainable materials and advanced manufacturing techniques. Continental AG, on the other hand, appears to be concentrating on expanding its footprint in North America through strategic acquisitions and partnerships, thereby enhancing its market share. Michelin is also investing heavily in digital transformation, aiming to optimize its supply chain and improve customer engagement, which collectively influences the competitive environment by fostering a culture of continuous improvement and responsiveness to market demands.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure is moderately fragmented, with several players vying for market share, yet the collective influence of major companies like Goodyear, Continental, and Michelin is substantial. Their strategies not only drive competition but also set benchmarks for operational excellence and innovation within the industry.

In October Goodyear Tire & Rubber Company (US) announced a partnership with a leading tech firm to develop AI-driven predictive maintenance solutions for tire performance. This strategic move is likely to enhance customer satisfaction by providing real-time data analytics, thereby reducing downtime and improving safety. Such innovations may position Goodyear as a leader in integrating technology with traditional manufacturing processes, potentially reshaping customer expectations in the market.

In September Continental AG (DE) launched a new line of eco-friendly tires made from sustainable materials, reflecting its commitment to environmental stewardship. This initiative not only aligns with global sustainability trends but also caters to the growing consumer demand for greener products. By prioritizing sustainability, Continental may strengthen its brand reputation and appeal to environmentally conscious consumers, which could lead to increased market share.

In August Michelin (FR) unveiled a digital platform aimed at enhancing supply chain transparency and efficiency. This platform is designed to provide real-time tracking of materials and products, thereby improving operational efficiency and reducing waste. The strategic importance of this initiative lies in its potential to streamline operations and foster stronger relationships with suppliers and customers, ultimately enhancing Michelin's competitive edge in the market.

As of November current trends in the nitrite butadiene-rubber market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, sustainability, and supply chain reliability. Companies that successfully navigate these trends may emerge as leaders in a rapidly changing market.