Expansion of the Pharmaceutical Pipeline

The nasal mucosa-drug-supply-device market benefits from the expansion of the pharmaceutical pipeline, particularly for drugs targeting central nervous system disorders and respiratory conditions. Pharmaceutical companies are increasingly exploring nasal delivery as a viable route for drug administration, given its potential for rapid absorption and improved patient compliance. Recent data shows that over 30 new nasal formulations are expected to enter the market in the next two years, targeting various therapeutic areas. This influx of new products is likely to stimulate competition and innovation within the market, ultimately enhancing the range of options available to patients and healthcare providers.

Advancements in Drug Formulation Technologies

Innovations in drug formulation technologies significantly impact the nasal mucosa-drug-supply-device market. The development of new formulations that enhance drug stability and bioavailability is crucial for improving therapeutic outcomes. For instance, the incorporation of nanotechnology and mucoadhesive agents in formulations can lead to prolonged drug retention in the nasal cavity, thereby increasing efficacy. Market analysis suggests that the formulation segment is expected to account for a substantial share of the market, with a projected growth rate of around 7% annually. These advancements not only improve patient compliance but also open avenues for the development of new therapeutic agents, further driving market growth.

Rising Awareness of Nasal Drug Delivery Benefits

There is a growing awareness among healthcare professionals and patients regarding the benefits of nasal drug delivery systems. This awareness is fueled by educational initiatives and marketing efforts that highlight the advantages of nasal administration, such as rapid onset of action and avoidance of first-pass metabolism. As a result, the nasal mucosa-drug-supply-device market is witnessing increased adoption across various therapeutic areas, including pain management and vaccination. Recent surveys indicate that approximately 60% of healthcare providers are now recommending nasal delivery systems as a viable alternative to traditional routes. This shift in perception is likely to bolster market growth as more patients seek effective and convenient treatment options.

Increasing Demand for Non-Invasive Delivery Systems

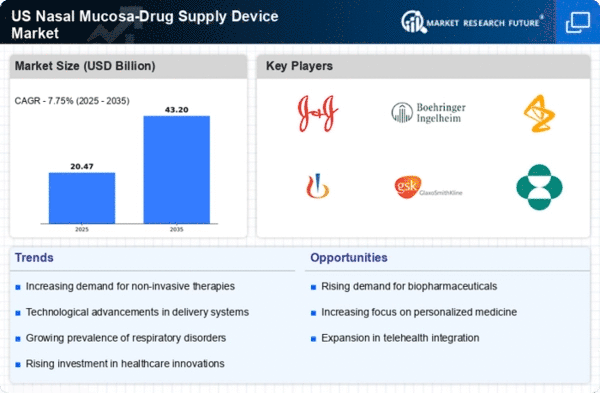

The nasal mucosa-drug-supply-device market experiences a notable surge in demand for non-invasive drug delivery systems. Patients increasingly prefer these methods due to their ease of use and reduced discomfort compared to traditional injections. This trend is particularly pronounced in the treatment of chronic conditions such as allergies and respiratory diseases, where nasal delivery offers rapid absorption and onset of action. Market data indicates that the non-invasive drug delivery segment is projected to grow at a CAGR of approximately 8% over the next five years. As healthcare providers and patients alike recognize the benefits of nasal delivery systems, the market is likely to expand, driven by innovations in device design and formulation technologies.

Regulatory Support for Nasal Drug Delivery Innovations

Regulatory bodies are increasingly supportive of innovations in nasal drug delivery systems, which positively influences the nasal mucosa-drug-supply-device market. Streamlined approval processes and guidelines for nasal formulations encourage pharmaceutical companies to invest in research and development. Recent initiatives by the FDA to expedite the review of novel drug delivery systems have led to a more favorable environment for market entrants. As a result, the market is expected to see a rise in the number of approved nasal drug products, potentially increasing market revenue by 10% over the next few years. This regulatory support not only fosters innovation but also enhances patient access to advanced therapeutic options.