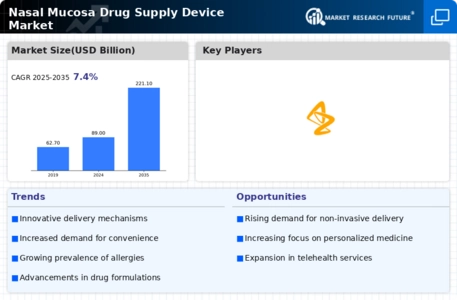

Rising Prevalence of Respiratory Disorders

The increasing incidence of respiratory disorders, such as asthma and allergic rhinitis, is a primary driver for the Nasal Mucosa Drug Supply Device Market. According to health statistics, respiratory diseases affect millions, leading to a heightened demand for effective treatment options. Nasal drug delivery systems are favored for their rapid absorption and localized effect, making them suitable for managing these conditions. The market is projected to grow as more patients seek non-invasive alternatives to traditional therapies. This trend indicates a shift towards devices that can deliver medications directly to the nasal mucosa, enhancing therapeutic outcomes. As awareness of respiratory health rises, the Nasal Mucosa Drug Supply Device Market is likely to expand, driven by the need for innovative solutions that cater to this growing patient population.

Technological Innovations in Drug Delivery

Technological advancements in drug delivery systems are significantly influencing the Nasal Mucosa Drug Supply Device Market. Innovations such as smart inhalers and micro-needling devices are enhancing the efficacy and user experience of nasal drug delivery. These technologies allow for precise dosing and improved patient compliance, which are critical factors in chronic disease management. The integration of digital health solutions, such as mobile applications for monitoring usage, is also gaining traction. Market data suggests that the adoption of these advanced devices is expected to increase, as they offer improved therapeutic benefits and convenience. Consequently, the Nasal Mucosa Drug Supply Device Market is poised for growth, driven by the continuous evolution of technology that enhances drug delivery methods.

Regulatory Support for Innovative Therapies

Regulatory bodies are increasingly supporting the development of innovative therapies, which is a key driver for the Nasal Mucosa Drug Supply Device Market. Streamlined approval processes and incentives for research and development are encouraging manufacturers to invest in new nasal drug delivery technologies. This regulatory environment fosters innovation, allowing for the introduction of advanced devices that meet patient needs. Market trends indicate that as regulations become more favorable, the number of new products entering the market is likely to increase. This influx of innovative solutions is expected to enhance competition and drive growth within the Nasal Mucosa Drug Supply Device Market, as companies strive to meet the evolving demands of healthcare providers and patients.

Growing Demand for Non-Invasive Treatment Options

The rising preference for non-invasive treatment options is a significant driver for the Nasal Mucosa Drug Supply Device Market. Patients increasingly favor methods that minimize discomfort and reduce recovery time. Nasal drug delivery systems provide a viable alternative to injections and oral medications, offering rapid onset of action and localized effects. This trend is particularly evident in the management of chronic conditions, where patient adherence is crucial. Market analysis indicates that the demand for non-invasive devices is likely to rise, as healthcare providers and patients seek effective solutions that align with modern treatment paradigms. The Nasal Mucosa Drug Supply Device Market is thus expected to benefit from this shift towards less invasive therapeutic options.

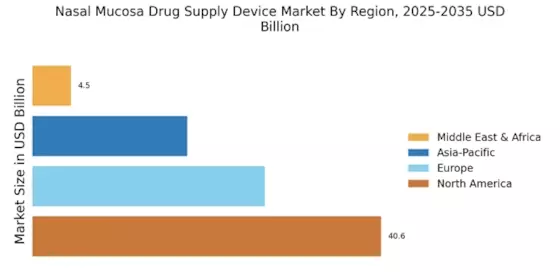

Increased Investment in Healthcare Infrastructure

The expansion of healthcare infrastructure is a notable driver for the Nasal Mucosa Drug Supply Device Market. Governments and private entities are investing in healthcare facilities and technologies to improve patient care. This investment is particularly evident in emerging markets, where access to advanced medical devices is becoming more widespread. Enhanced healthcare infrastructure facilitates the adoption of innovative drug delivery systems, including nasal devices, which are gaining recognition for their effectiveness. Market data suggests that as healthcare systems evolve, the demand for nasal mucosa drug supply devices will likely increase, driven by the need for efficient and effective treatment options. This trend indicates a positive outlook for the Nasal Mucosa Drug Supply Device Market as it aligns with broader healthcare improvements.