Increased Focus on Sleep Disorders

The growing focus on sleep disorders, including narcolepsy, is shaping the narcolepsy market. As awareness of the impact of sleep on overall health increases, healthcare providers are more likely to screen for sleep-related conditions. This trend is supported by research indicating that untreated narcolepsy can lead to significant impairments in quality of life and productivity. Consequently, there is a push for better diagnostic tools and treatment protocols, which may enhance patient outcomes. The integration of sleep medicine into primary care practices is also likely to facilitate earlier diagnosis and treatment initiation. As the healthcare landscape evolves to prioritize sleep health, the narcolepsy market is expected to benefit from increased demand for effective therapies.

Increasing Prevalence of Narcolepsy

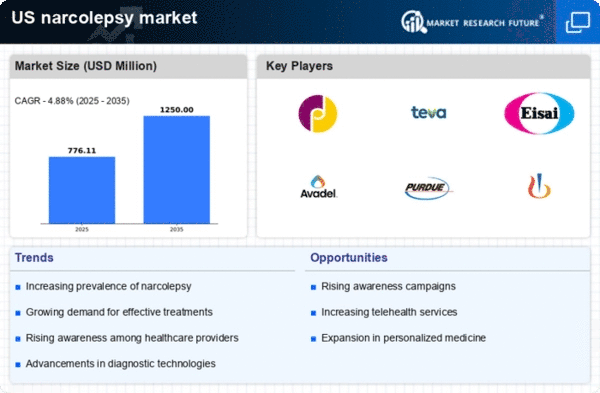

The rising prevalence of narcolepsy in the US is a crucial driver for the narcolepsy market. Recent estimates suggest that narcolepsy affects approximately 1 in 2,000 individuals, leading to a growing patient population requiring effective treatment options. This increase in diagnosed cases is likely to stimulate demand for medications and therapies, thereby expanding the market. Furthermore, the heightened awareness among healthcare professionals and patients about the symptoms and implications of narcolepsy contributes to earlier diagnosis and treatment initiation. As more individuals seek medical attention for their symptoms, the narcolepsy market is expected to experience significant growth, with projections indicating a potential market value exceeding $1 billion by 2027.

Growing Support from Advocacy Groups

The increasing support from advocacy groups is significantly influencing the narcolepsy market. Organizations dedicated to raising awareness about narcolepsy are actively engaging in educational campaigns, which help to inform both the public and healthcare providers about the condition. This advocacy is crucial in reducing stigma and encouraging individuals to seek diagnosis and treatment. Additionally, these groups often collaborate with researchers and pharmaceutical companies to promote clinical trials, thereby facilitating the development of new therapies. The heightened visibility of narcolepsy issues is likely to lead to increased funding for research and improved access to treatments, ultimately benefiting patients. As advocacy efforts continue to grow, the narcolepsy market may see a corresponding increase in demand for effective treatment options.

Regulatory Support for New Treatments

Regulatory support for the approval of new treatments is a vital driver for the narcolepsy market. The US Food and Drug Administration (FDA) has been increasingly proactive in expediting the review process for innovative therapies, particularly those addressing rare diseases like narcolepsy. This supportive regulatory environment encourages pharmaceutical companies to invest in the development of new medications, knowing that they may receive faster approval and market access. The recent introduction of breakthrough therapy designations for promising narcolepsy treatments exemplifies this trend. As more therapies gain approval, the narcolepsy market is likely to expand, providing patients with a broader range of options to manage their condition effectively.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are propelling the narcolepsy market forward. The development of new drugs, particularly those targeting the underlying mechanisms of narcolepsy, is likely to enhance treatment efficacy and patient outcomes. Recent advancements in wake-promoting agents and orexin receptor antagonists have shown promise in clinical trials, indicating a shift towards more effective therapies. The US market has seen a surge in investment in research and development, with pharmaceutical companies allocating substantial resources to discover novel treatments. This focus on innovation not only addresses unmet medical needs but also fosters competition, which may lead to more affordable options for patients. As a result, the narcolepsy market is poised for expansion, with a projected compound annual growth rate (CAGR) of around 8% over the next five years.