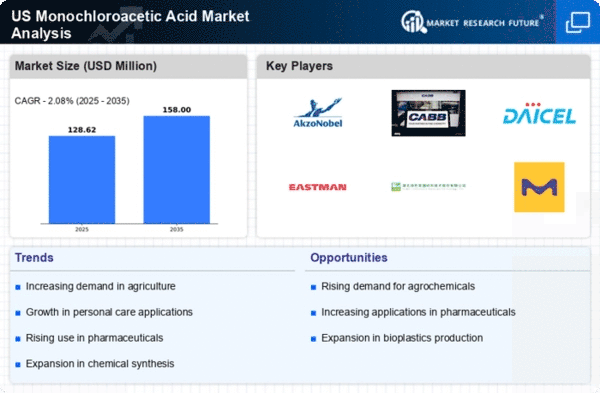

The monochloroacetic acid market exhibits a competitive landscape characterized by a blend of established players and emerging companies, driven by increasing demand across various end-use industries such as agrochemicals, pharmaceuticals, and personal care. Key players like Eastman Chemical Company (US), The Chemours Company (US), and CABB Group (DE) are strategically positioned to leverage their extensive manufacturing capabilities and innovation-driven approaches. These companies focus on enhancing product quality and expanding their market reach, which collectively shapes a dynamic competitive environment.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several key players exerting influence over pricing and product availability. This fragmentation allows for niche players to emerge, yet the collective strength of major companies like AkzoNobel (NL) and Daicel Corporation (JP) ensures a competitive balance that drives innovation and efficiency.

In October Eastman Chemical Company (US) announced the launch of a new line of sustainable monochloroacetic acid products aimed at reducing environmental impact. This strategic move not only aligns with global sustainability trends but also positions Eastman as a leader in eco-friendly chemical solutions, potentially attracting environmentally conscious customers and enhancing brand loyalty.

In September The Chemours Company (US) expanded its production capacity for monochloroacetic acid at its facility in Texas. This expansion is significant as it reflects Chemours' commitment to meeting the growing demand in North America, thereby strengthening its market position. The increased capacity may also facilitate better supply chain management and responsiveness to customer needs.

In August CABB Group (DE) entered into a strategic partnership with a leading agrochemical firm to develop specialized formulations using monochloroacetic acid. This collaboration is indicative of CABB's focus on innovation and market expansion, as it seeks to enhance its product offerings and tap into the lucrative agrochemical sector, which is expected to grow substantially in the coming years.

As of November the competitive trends in the monochloroacetic acid market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances are becoming more prevalent, allowing companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market demands.