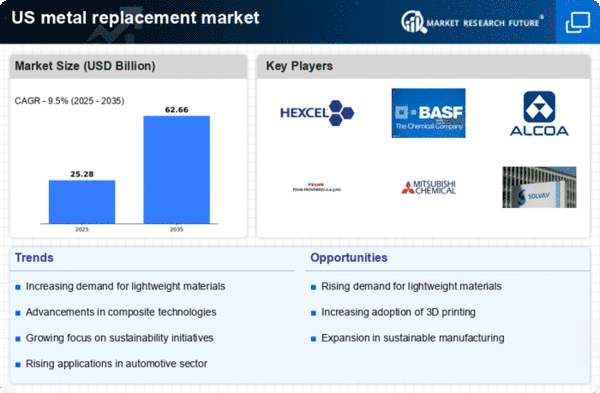

The metal replacement market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for lightweight materials and sustainable solutions across various industries. Key players such as Hexcel Corporation (US), Alcoa Corporation (US), and DuPont de Nemours, Inc. (US) are strategically positioned to leverage innovation and technological advancements. Hexcel Corporation (US) focuses on advanced composite materials, emphasizing aerospace applications, while Alcoa Corporation (US) is enhancing its aluminum solutions to cater to automotive and construction sectors. DuPont de Nemours, Inc. (US) is investing in high-performance polymers, which are gaining traction in the electronics and automotive industries. Collectively, these strategies indicate a shift towards more sustainable and efficient material solutions, shaping the competitive environment.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and enhance supply chain resilience. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies is significant, as they drive innovation and set industry standards. This competitive structure fosters an environment where collaboration and strategic partnerships are essential for growth and market penetration.

In October Hexcel Corporation (US) announced a partnership with a leading aerospace manufacturer to develop next-generation composite materials aimed at reducing aircraft weight and improving fuel efficiency. This collaboration is strategically important as it aligns with the industry's push towards sustainability and operational efficiency, potentially positioning Hexcel as a leader in aerospace material innovation.

In September Alcoa Corporation (US) unveiled a new aluminum alloy designed for electric vehicle applications, which promises to enhance performance while reducing weight. This development is crucial as it addresses the growing demand for lightweight materials in the automotive sector, particularly in the context of electric vehicle production, thereby reinforcing Alcoa's competitive edge in this rapidly evolving market.

In August DuPont de Nemours, Inc. (US) launched a new line of high-performance polymers specifically tailored for the electronics industry, focusing on thermal management and durability. This strategic move is indicative of DuPont's commitment to innovation and its ability to adapt to the changing needs of the market, potentially enhancing its market share in the electronics sector.

As of November current trends in the metal replacement market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and deliver sustainable solutions.