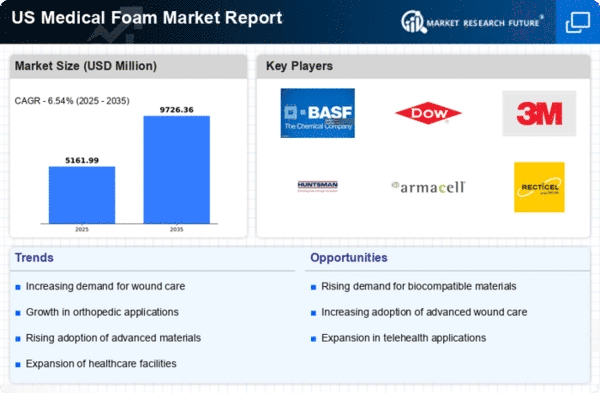

The medical foam market exhibits a dynamic competitive landscape characterized by innovation and strategic partnerships. Key players such as BASF SE (DE), Dow Inc. (US), and 3M Company (US) are actively shaping the market through their focus on product development and sustainability initiatives. BASF SE (DE) emphasizes innovation in biocompatible materials, while Dow Inc. (US) leverages its extensive research capabilities to enhance foam performance. 3M Company (US) is known for its commitment to sustainability, integrating eco-friendly practices into its manufacturing processes. Collectively, these strategies foster a competitive environment that prioritizes technological advancement and environmental responsibility.The market structure appears moderately fragmented, with several players vying for market share through localized manufacturing and optimized supply chains. Companies are increasingly localizing production to reduce lead times and enhance responsiveness to regional demands. This tactic not only improves operational efficiency but also strengthens relationships with local healthcare providers. The collective influence of major players contributes to a competitive atmosphere where innovation and customer-centric approaches are paramount.

In October 3M Company (US) announced a partnership with a leading healthcare provider to develop advanced wound care solutions utilizing their proprietary foam technology. This collaboration is strategically significant as it aligns with the growing demand for specialized medical products that enhance patient outcomes. By leveraging its expertise in foam technology, 3M Company (US) positions itself as a leader in the wound care segment, potentially increasing its market share and reinforcing its commitment to innovation.

In September Dow Inc. (US) launched a new line of medical foams designed for use in surgical applications, emphasizing biocompatibility and performance. This strategic move reflects Dow's focus on expanding its product portfolio to meet the evolving needs of the healthcare sector. The introduction of these foams not only enhances Dow's competitive positioning but also addresses the increasing demand for high-performance materials in surgical environments.

In August BASF SE (DE) expanded its production capacity for medical foams in North America, responding to the rising demand for healthcare products. This expansion is indicative of BASF's commitment to meeting market needs while enhancing its operational capabilities. By increasing production capacity, BASF SE (DE) aims to solidify its market presence and ensure timely delivery of innovative solutions to its customers.

As of November current trends in the medical foam market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the competitive landscape, fostering innovation and enhancing product offerings. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident. Companies that prioritize innovation and sustainability are likely to differentiate themselves in this evolving market, positioning themselves for long-term success.